Data-Driven Sustainability for Asia

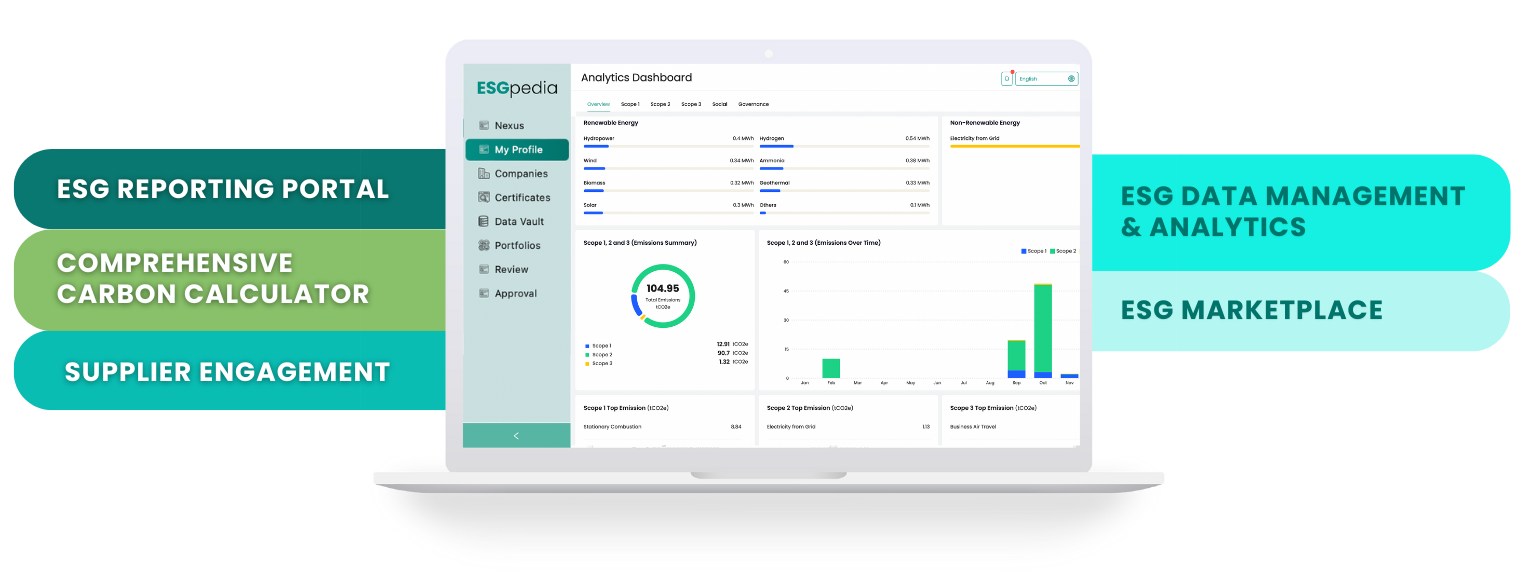

ESGpedia is your one-stop digital platform of ESG data and solutions for corporates, SMEs, and financial institutions across the Asia Pacific region to attain ESG goals

Partners

5 million

Sustainability

Data Points

868,000

ESG Certificates

(& growing)

119,000+

ESG Credentials

(& growing)

508,000+

companies’

sustainability data

156,000+

company profiles with full corporate data overlaid and standardized

Focus on your core business, leave ESG to us

ESG Reporting

Sustainability

and Analytics

- Streamline complicated ESG reporting processes

- Green your supply chains

our ESGpedia Marketplace

- Sustainability Certifications

- Sustainability-Linked Finance

- Get ESG Assurance

- Carbon Offsets & more

End-to-end ESG Solutions for Businesses

Kickstart your ESG journey and gain a competitive edge:

Gain competitive advantage, amplified by ESGpedia’s Unique Network

Ensure regulatory compliance

Specialised in engaging Asia ecosystems and supply chains

Access benefits through our network effect. Get connected with our Marketplace for integrated actionable ESG strategies, including Assurance, Certifications, Financing, Green Procurement, Advisory, Carbon Offsets, and more.

Built for compliance, credibility, and accuracy, ESGpedia covers comprehensive ESG reporting frameworks, including both international and local standards. Calculate GHG emissions in accordance with the GHG Protocol and ISO14064 methodology.

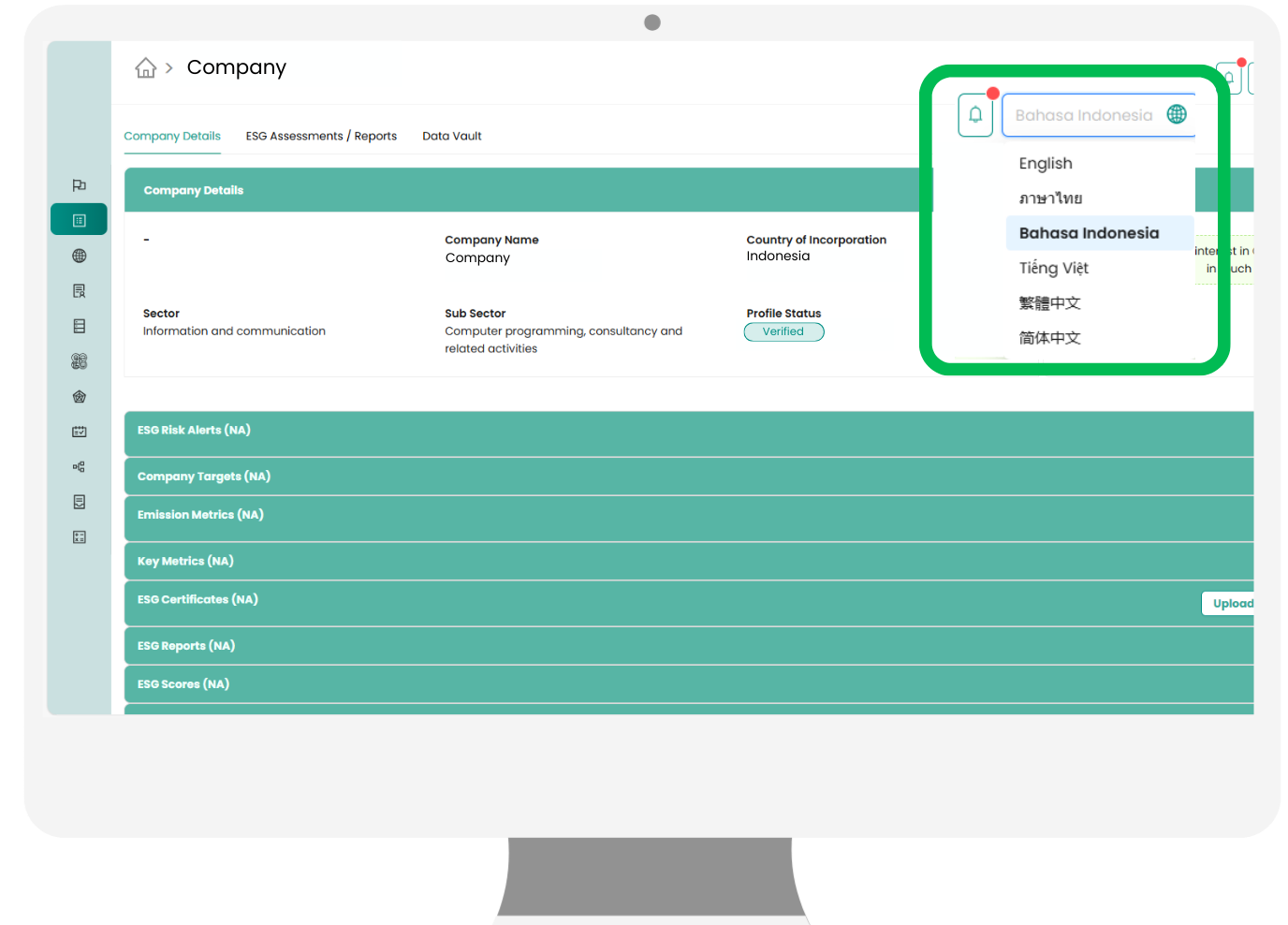

Companies, SMEs, and suppliers can access the platform in their preferred language for a seamless experience. Over 200,000 emission factors hyper-localised to all APAC countries, covering 1000 product categories and various sectors.

Asia’s Leading ESG Solution

Achieving Corporate Sustainability with ESGpedia

Live Industry Use Cases

Sustainability-Linked Financing

Built for businesses’ end-to-end ESG needs

Navigate ESG data and regulations with ease