Data-Driven Sustainability for Asia

ESGpedia is your one-stop digital platform of ESG data and solutions for financial institutions, corporates, and SMEs across Asia to attain ESG goals

How It All Comes Together

Asia’s Leading ESG Solution

Aggregated & harmonised ESG data and digital tools to enable your net-zero journey. Integrated with a robust ecosystem of partners.

5 million

Sustainability Data Points

697,000

ESG Certificates

(& growing)

85,000+

ESG Credentials (& growing)

386,000+

companies’ sustainability data

152,000+

company profiles with full corporate data overlaid and standardized

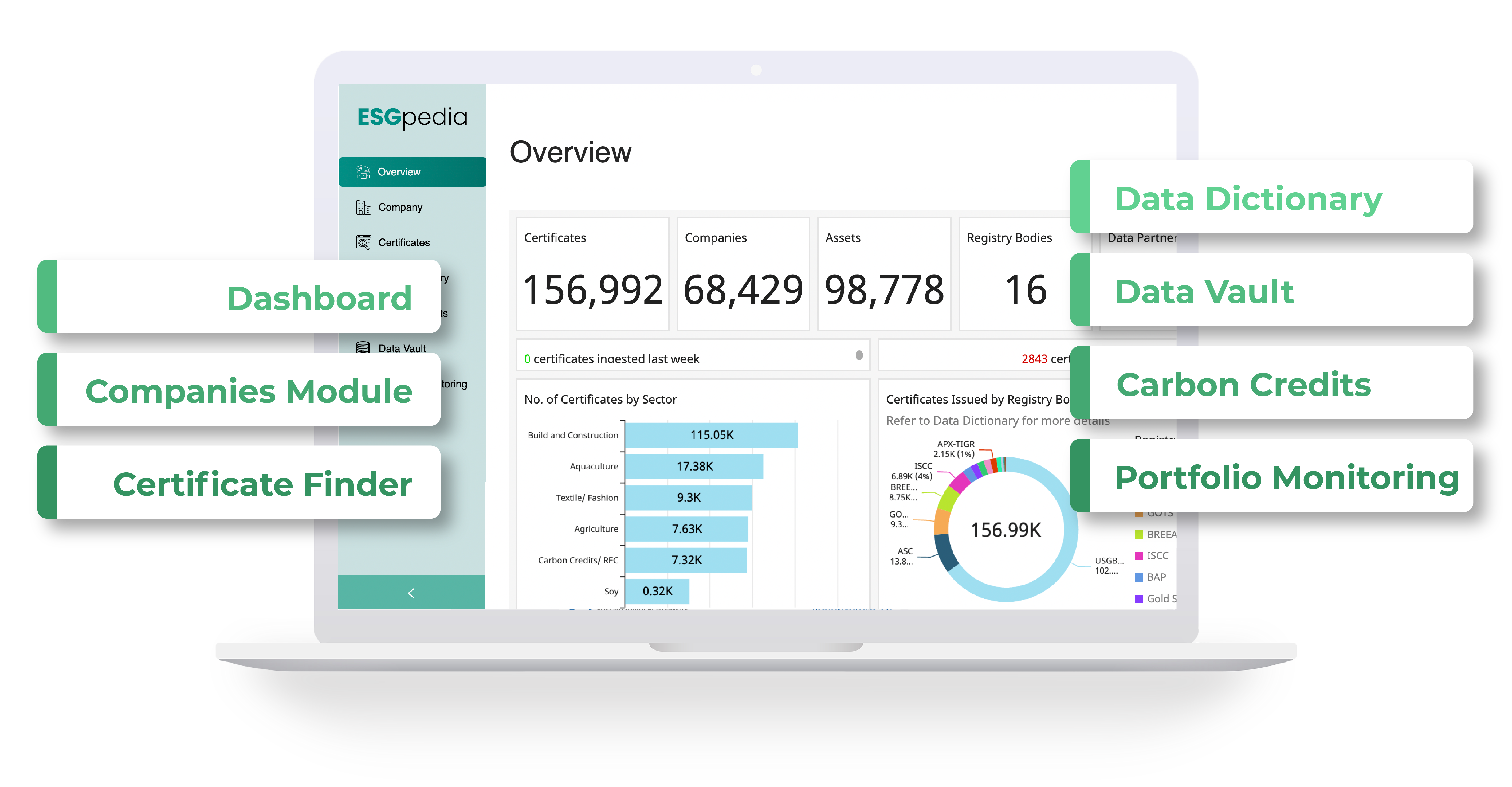

Core Features

Holistic and Forward-Looking ESG Data

Data Disclosures, Ongoing Project Data,

ESG Certifications

Ongoing Monitoring

A micro and macro view of corporates

sustainability progress

Data Mapping

Guiding corporates towards compliance with

ESG reporting standards and frameworks

Transparency

Availability of high quality, robust forward-looking data to facilitate ongoing oversight

Inclusivity

Empowers corporates of any sizes to tap on ourecosystem to quickly embark on their green journey

Efficiency

Enables one-stop access to holistic ESG data

to effectively facilitate financing decision

About ESGpedia

Access a complete ESG database of over 5 million sustainability data points across countries and sectors, aggregated and harmonised on a single registry, to enhance the mobilisation of ESG capital. Technology partner of the Monetary Authority of Singapore’s (MAS) Project Greenprint.

Dashboard

Be in control – Simple and Readily Available

Data Providers

Logistic Sector

Construction Sector

Agriculture Sector

Sector

Sector

Sectors

Ongoing high-quality ESG data

Data Users

Green and Sustainability-Linked

Loans or Bonds

InvestorsFor monitoring of investees in

Funds, Private Equities, REITS

Insurers

Sustainability-linked

insurance

ExchangesFor the support of data-backed

RECs & Carbon Credits

Partners

Technology partner of the Monetary Authority of Singapore’s (MAS) Project Greenprint

ESBN Asia-Pacific

Green Deal for Businesses

Discover the free digitalised and simplified ESG self-assessment

for corporates and SMEs today.

Step-by-step tutorial guide available

ESG Data and Certifications for companies

from various sectors and global verified sources

Banks, Investors, Asset Managers, Insurers, RECs & Carbon Credit Exchanges

ESG financing and investment decisions

management of ESG financial products

and digitally-empowered ESG Financial Products