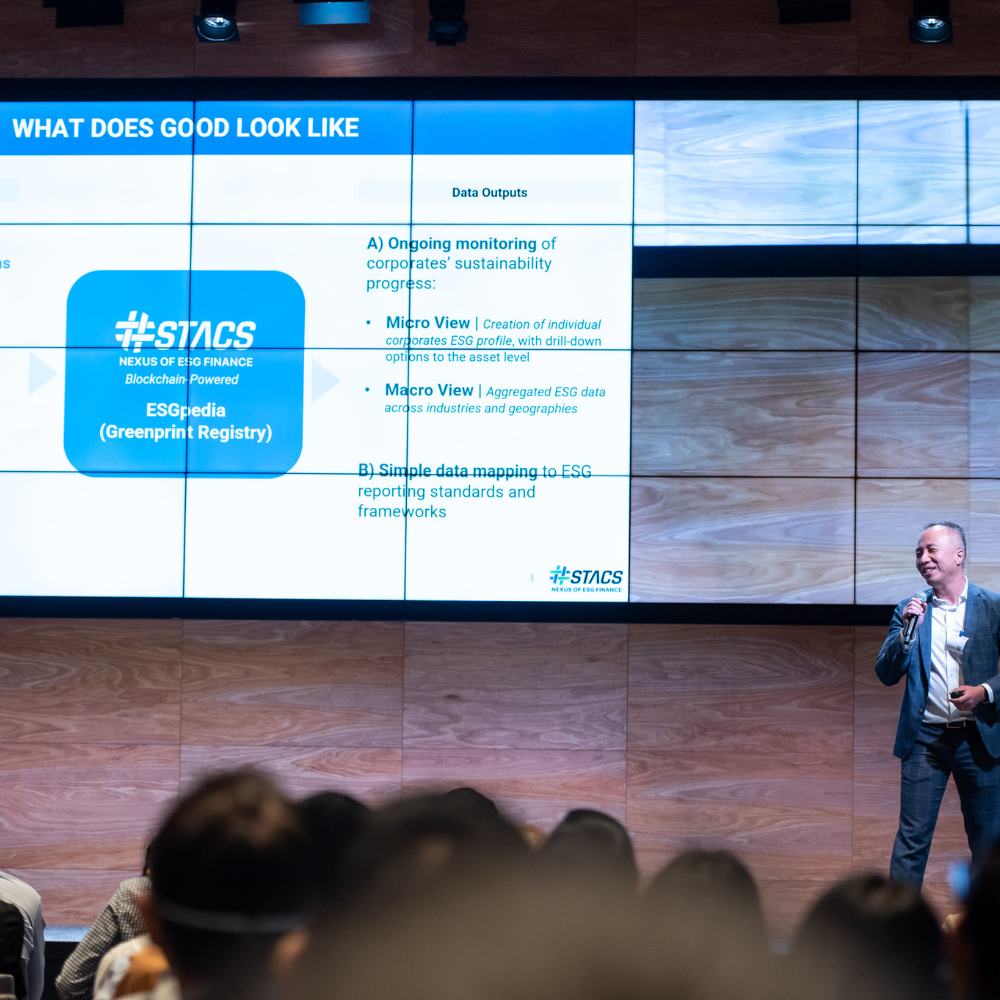

Enabling Sustainability as The Nexus of ESG

Helping companies of all sizes achieve ESG goals via technology

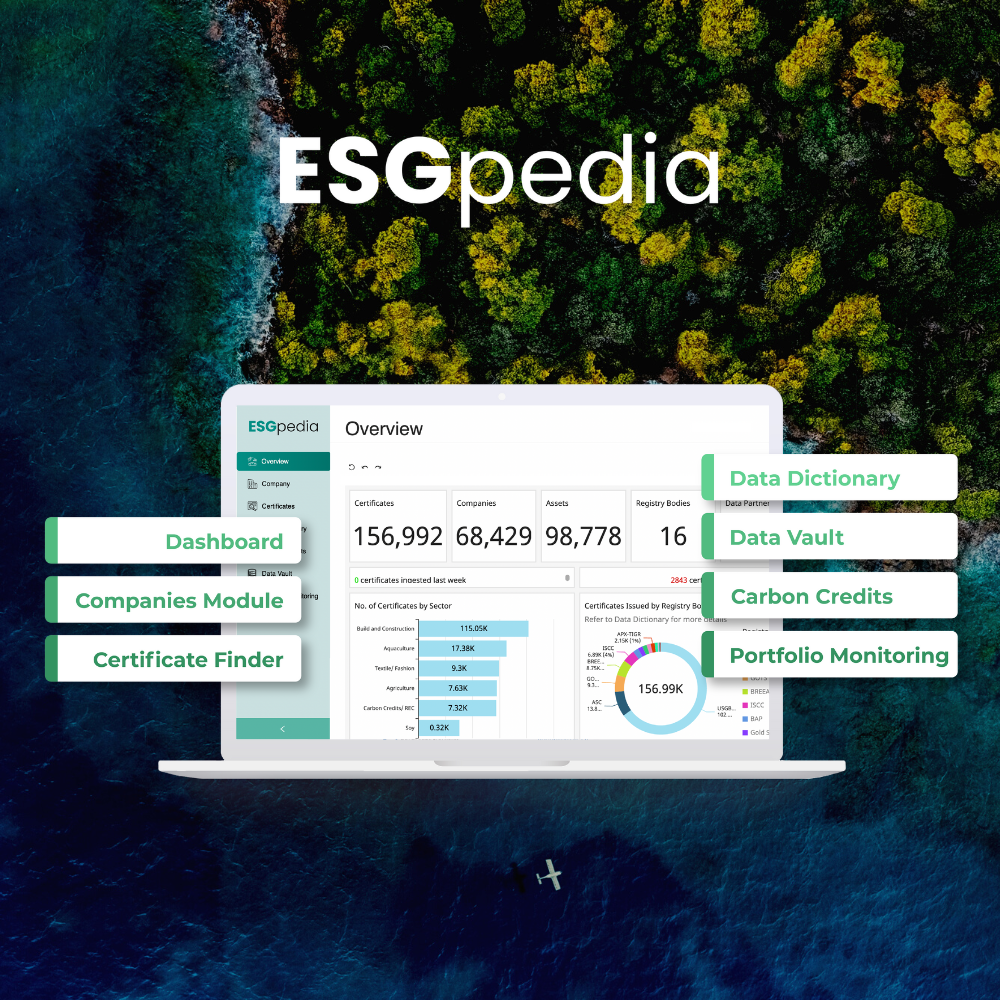

Asia’s Leading ESG Solution

Aggregated & harmonised ESG data and digital tools to enable your net-zero journey. Integrated with a robust ecosystem of partners.

5 million

Sustainability Data Points

697,000

ESG Certificates

(& growing)

85,000+

ESG Credentials (& growing)

386,000+

companies’ sustainability data

152,000+

company profiles with full corporate data overlaid and standardized

Use Cases

Begin your net zero journey today

ESBN Asia-Pacific

Green Deal for Businesses

Discover the free digitalised and simplified ESG self-assessment for corporates and SMEs today.

Step-by-step tutorial guide available

Our Story and Milestones

Bringing forward the future of Sustainable Finance

Gartner Eye on Innovation

Award for Financial Services 2020

Mercury – Asia Pacific Winner

FSTI Grant 2020 by MAS

Two-times awardee

DigFin Innovation Awards 2021

Best FinTech ESG Solution

Monetary Authority

of Singapore (MAS)

Global Fintech Innovation

Challenge Award 2020

UBS Future of Finance

Challenge 2019

Global Finalist

Project UBIN led by MAS

Technology Partner

Mastercard

Start Path

Blockchain firm