Supporting DLT Cross-Chain Integrations

Case Study: Project Ubin Phase 5

Project Ubin is a 6-phase collaborative project led by Singapore’s Central Bank to pioneer digital transformation. The prior 4 phases had focused on the creation of the DLT-based Digital Currency, and the DvP elements of payments.

In Phase V, STACS is the technology partner. The STACS Blockchain provides the securities ledger, for the fulfilment of Delivery vs Payment (DvP), against the Ubin Payments Network. Capital Market participants within the project move from DLT experimentation to commercial production use, while achieving certainty in the instant delivery of payments against securities.

Technology

Partner

Central Bank-issued Digital Currency (UBIN’s Payment Network)

Jurisdiction

Integrating Capital Markets with Singapore’s Central

Bank Digital Currency and DLT Payments Network

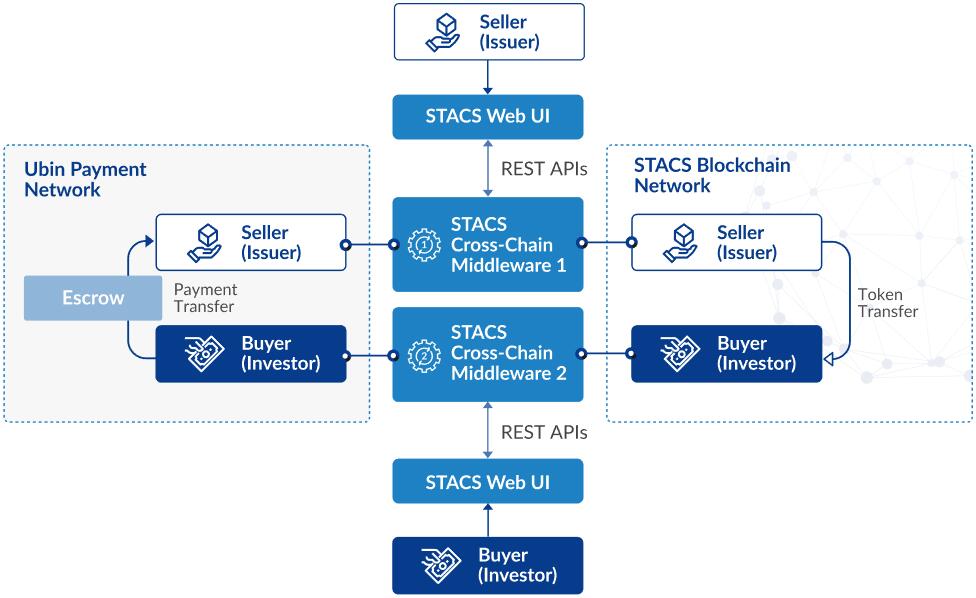

STACS securities ledger integrates with the Ubin Payments Network to provide cross-chain settlement:

Moving capital market use cases from experimentation to commercial production

Fulfil instant settlement of different assets,

across different DLT technologies

Cross-Chain Integrations and Settlements

Pain Points

![]() The need for the desired DLT infrastructure to connect with other DLT projects, in order to avoid:

The need for the desired DLT infrastructure to connect with other DLT projects, in order to avoid:

- Silo-ed environments from an ineffective DLT investment

- Difficulty of gaining legal certainty

Opportunities

- Cross-chain settlement (Delivery versus Payment of securities and payments, across different DLT technologies)

- The flexible ability to integrate STACS with the payment networks provided by central banks

- Market participants move from DLT experimentation to commercial production

![]() A larger liquidity hub:

A larger liquidity hub:

- Flexiblity to use a variety of payment systems (including both the existing payments systems and the new DLT multi-payments networks)

Learn More About Project UBIN

MONETARY AUTHORITY OF SINGAPORE

Beyond technical experimentation, the current phase of Project Ubin, Phase 5, sought to determine the commercial viability and value of the blockchain-based payments network…

The first cohort of blockchain applications that were tested successfully were showcased at the Singapore FinTech Festival 2019. This included projects by industry partners like…Hashstacs…to test out integration with the Ubin prototype network for transaction processing.

THE ASSET

Singapore enterprise-blockchain technology provider STACS joins current phase of Project Ubin.

MEDIUM

“We are honoured to play a historic role in the international development of blockchain standards. To be integrated with Project Ubin confers great responsibility and trust. STACS has showcased that digitising the financial markets on blockchain is commercially viable given our direct involvement in Project Ubin,” said Jay Ng, Managing Director of STACS.

HACKERNOON

STACS worked closely with the Accenture team and the Ubin APIs to design and develop a scalable, production-ready

architecture that would deliver on both business requirements as well as customer experience.