Insights from COP27: Key takeaways on ESG Finance from STACS

Driving ESG Finance with Data

Sharon shared STACS’ insights, strategies, and case studies with the audience not long after our successful participation in Singapore Fintech Festival 2022 where we were involved in three presentations and roundtable discussions with key leaders in the industry.

Benjamin’s presentation highlights on COP27 Finance Day

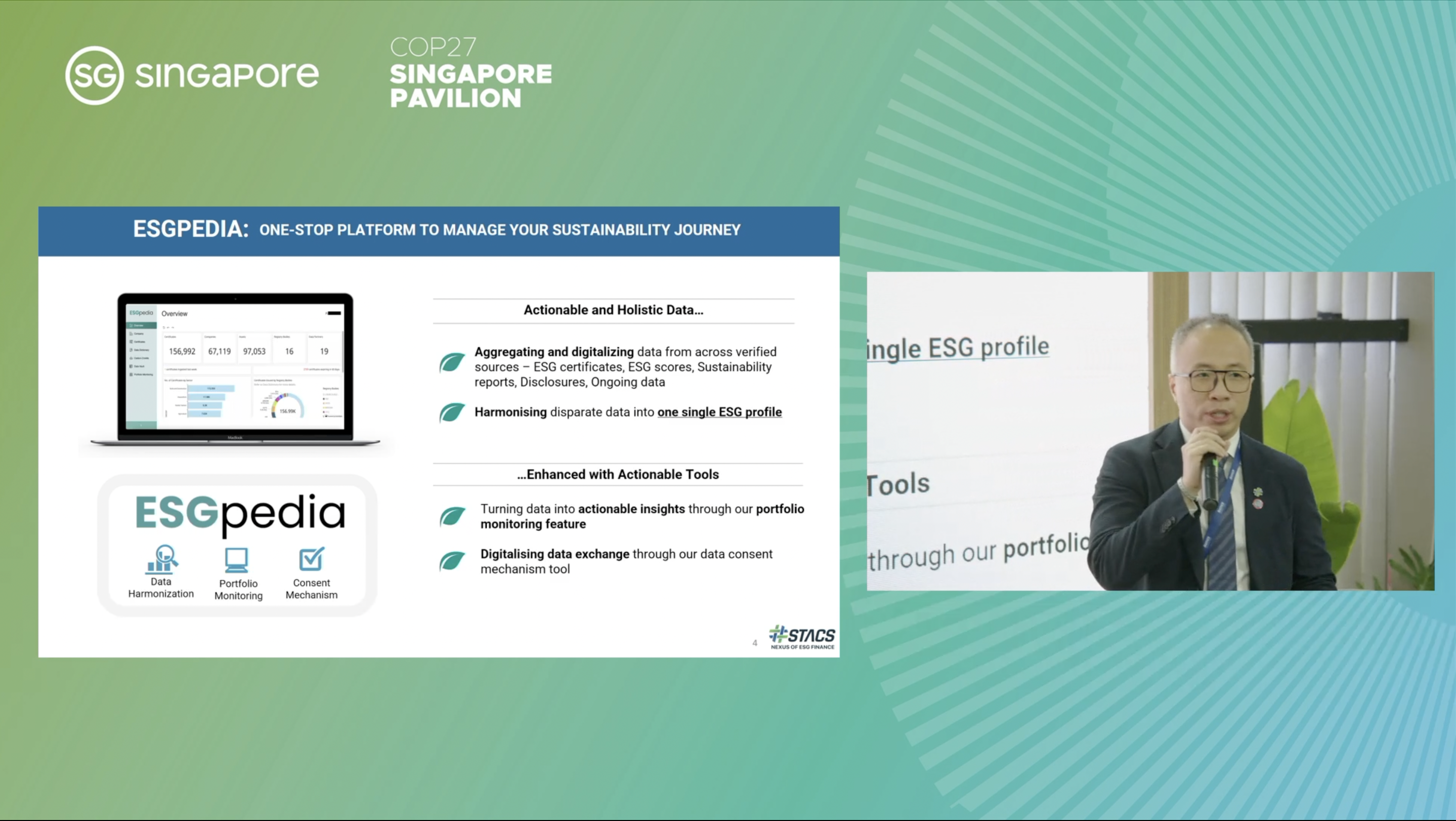

One year on from announcing our ESGpedia partnership with MAS’ Project Greenprint at COP26, it was great to be back at COP27 to share how ESGpedia is already in place today and empowering multiple sectors across Asia towards sustainability and net zero through holistic data, digital tools, and sustainable finance.

At the same time, we have also seen how SMEs in particular need an easier way to create their sustainability profile, to begin their ESG journey. Meanwhile, large companies buying from the SMEs want to see this sustainability data to track their own supply chain, usually done in partnership with financial institutions for net zero financing.

ESGpedia helps with these challenges by aggregating high-quality, granular data across various global verified data sources and sectors to support financial institutions, corporates, and SMEs to chart their decarbonisation pathways, evidence their efforts, and make real, transparent progress towards sustainability.

Data sources include certifications, CDP scores, sustainability reports, ongoing data (i.e. from drones, IoT, satellites), and self-disclosures, all streamlined into a one-stop platform, like how Wikipedia has a page (or ESG profile) for each company.

Another key part of what we do is around providing actionable tools for things like portfolio monitoring and private data consent, as shown to the audience via a demo by Benjamin during his presentation(video starts from 8:40).

ESGpedia 9 Live Use Cases on ESG Finance across sectors

Co-developing cross-sector use cases with industry partners big and small has been one of the key areas we’ve made progress on since launching ESGpedia a year ago, with live use cases spanning the following 10 (and growing) industry sectors:

- Investment Portfolio Monitoring

- High-Quality Carbon Credits

- Supplier Sustainability Monitoring

- Hospitality

- Fashion and Textile

- Transportation and Logistics

- Agriculture

- Built Environment and Efficiency-based Digital Carbon Verification

- Renewable Energy

- Data Centers

Learn how companies are embarking on ESG Finance and net zero with us through our Use Cases page here.

Financial institutions can create transparent ESG investment portfolios, ultimately sold as products to their own clients, while the companies themselves benefit from better sustainable financing and visibility – a win-win.

Green trade finance is another key use case we’ve made great progress on, covering sectors such as rubber, palm oil, cotton, and construction materials complete with agricultural/ construction certifications (this can include criteria such as factory emissions and labour rights of their workforce). Asia is a major supply chain to the rest of the world, especially in industries like fashion that have complex and deep supply chains across the region that are ultimately turned into products sold in Europe and North America, so it’s great to be able to partner with Singapore Fashion Council to better monitor the complex ESG credentials in the end-to-end supply chain in this space, and enable businesses in the fashion and textile sector to embark on net zero via Sustainable Financing.

We have also commenced Supplier Sustainability Monitoring with Maxeon Solar Technologies, a global leader in solar innovation and channels. Solar is a great green industry at the heart of the energy transition, but it’s important to understand the ESG profile and sustainability performance of suppliers in corporate’s end-to-end supply chain, given their complexity and heavy reliance on rare earth minerals. By monitoring and greenifying their supply chain, corporates can reduce their overall scope 3 emissions as well as the carbon footprint of their products.

We hope all these use cases will serve as important guideposts on the way to a more competitive Asia, which in future will still have to sell its products globally, but with greater attention paid to ESG-optimised supply chains and the introduction of carbon border adjustments in economic zones like Europe.

Investment portfolio monitoring through sustainability-linked bonds, which fund managers are already using, is another area we have been laser focused on at STACS, with the first partner on this use case being Manulife Investment Management, to help them track their ESG bonds.

Fractionalised Carbon Credits via Restorify by STACS and Razer

Finally, at COP27 itself, Benjamin announced the launch of our new carbon credits fractionalisation solution, Restorify, in partnership with gaming giant Razer Inc. and its 200 million customers worldwide.

Powered by STACS’ technologies, every Razer product purchase via its e-commerce store now shows an associated carbon footprint and option to offset it through fractionalised carbon credits, traceable end-to-end on ESGpedia.

Starting from the gaming industry, we seek to scale this solution to other industries (e.g. hospitality, fashion e-commerce, etc.) to enable them to attain sustainability and carbon neutrality, and encourage greater impact by making carbon offsets accessible to end-consumers.

Restorify can be easily embedded in your business’ e-commerce check-out feature. Learn more about high-quality carbon credits here.

Benjamin ended his presentation with an important update: STACS has a clear ambition to expand Asia-wide and go beyond its home market of Singapore in 2023!

Sharon’s panel highlights on Decarbonising Asia through Data and Carbon Credits

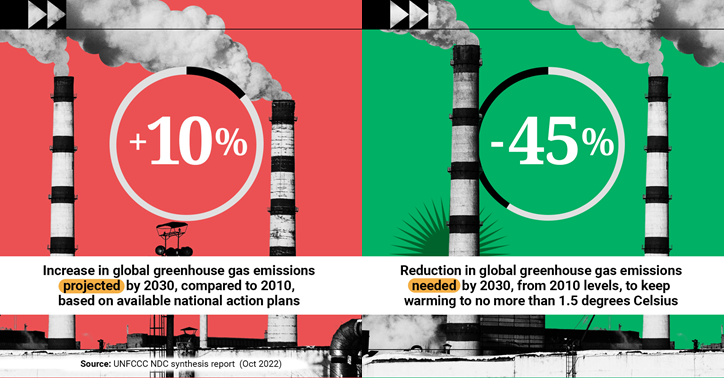

Asia Pacific accounts for over 50 per cent of global carbon emissions, which means this will be the key strategic region in determining whether we make or break the battle against climate change.

With MSMEs representing 90 percent of businesses globally and sustainability permeating into all aspects of supply chains today, it is undeniable that collaboration and collective action by players of all sizes are pivotal to move the climate change needle in Asia. Quoting Sharon Yuen, “This requires collective action and concerted efforts from all stakeholders: legislators, national government, investors, companies, and even households [and consumers].”

Watch Sharon’s COP27 panel discussion

As part of that, data will be a powerful tool in driving change and accelerating climate action, especially notable since the World Economic Forum has said data is a key ESG challenge for almost all businesses – yet exists in fragments and silos.

There is a lack of holistic and digital data, as well as forward-looking disclosures and real-time information by corporations, which typically disclose only once a year, while industry certifications can be costly and difficult to get, especially for smaller companies.

This mismatch on data in the market makes it harder for SMEs to attract ESG-related financing and at the same time, financial institutions are hesitant on mobilising sustainable finance due to fears over greenwashing compounded by a lack of transparent data and evidenced-efforts.

Technology is therefore a key enabler, to lower the barriers to entry by simplifying ESG for corporates especially MSMEs, and empowering companies to evidence their sustainability efforts to obtain sustainable financing.

The future of ESG Finance in Asia

The good news: there are already initiatives like the ESBN Asia-Pacific Green Deal for Business, as well as technology platforms like NZDPU and our ESGpedia registry in place to support a clear transition towards net zero.

For Asia to win this race against climate change, the time to take action is now. “Sustainability is no longer a choice. For businesses, being sustainable is the only way to be and to remain in business.”

Learn more about ESG finance and read our 2022 Year in Review here for our key highlights of the year as we pave a clear pathway for Asia’s net zero transition.

Connect with us here to find out about ESG finance and how you can help your company achieve net zero.