We were generously hosted at the Everest Room, Google Asia Pacific, Singapore office in May for the launch of our ESGpedia platform in partnership with the Monetary Authority of Singapore (MAS) and key partners from the world of asset management, banks, exchanges, insurers, and financial services.

ESGpedia is powering the ESG Registry of the MAS’s Project Greenprint and is the clearest evidence yet of the importance both public and private sectors are placing on the value of ESG data.

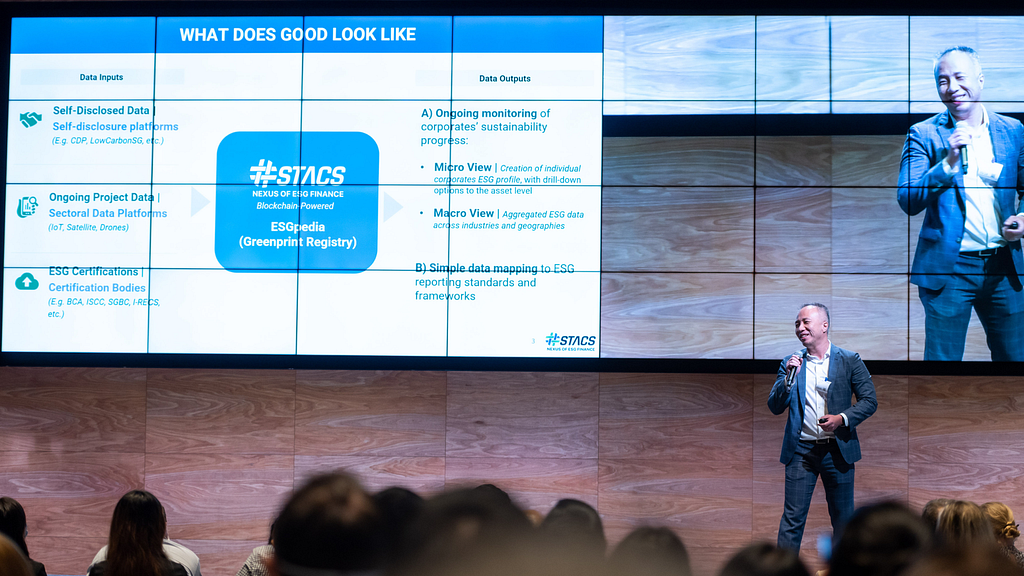

We’ve had conversations with more than 150 organisations in the past six months, helping us gain a deep understanding of what “good” looks like to the industry as a whole and allowing us to continuously enhance our ESGpedia platform with that feedback.

ESGpedia is seeing rapid adoption

As mentioned, ESGpedia was developed to serve as the Project Greenprint ESG registry here in Singapore and is already being actively deployed today with the goal of providing an online encyclopedia for ESG data.

As of today, ESGpedia is integrated with self-disclosure platforms like CDP, LowCarbonSG from GCNS, and we will be adding more when ready.

We are also integrating with ongoing data platforms across fleet management, building management systems, and agriculture/plantation management platforms — all leveraging Internet of Things (IoT), satellites, and drone technology that allows us to capture data directly from the project source on an ongoing basis.

Of course, some companies have already achieved ESG certification through third-party verification providers such as BCA Green Mark, SGBC, RSS/RSPO, Vera and Gold Standard, and Irex/ISO.

In ESGpedia we have digitally aggregated data from all these sources on a single platform with structured data made interoperable across a variety of use cases.

This supports ongoing monitoring and forward-looking views of companies’ sustainability commitments and profiles, right down to the subsidiary asset or product level.

It also allows for a bird’s eye view across sectors and geographies as an entire value chain, mapped against industry standards and frameworks.

Hundreds of thousands of certificates, companies, and assets

We’re pleased to have already partnered with more than 20 financial institutions and integrated with more than 10 certification bodies and 8 sectoral data platforms, covering 170,000 certificates, 60,000 companies, and 110,000 assets.

When you log into the ESGpedia platform, you are able to search by company, sector or certificate type/issuer across geographies, assets, and periods — all downloadable into multiple formats.

Our ESG Data Vault integrates our registry with third-party platforms such as CO2 Connect for IoT fleet management data, Surbana Jurong for building management data, and U-Reg for renewable energy assets data.

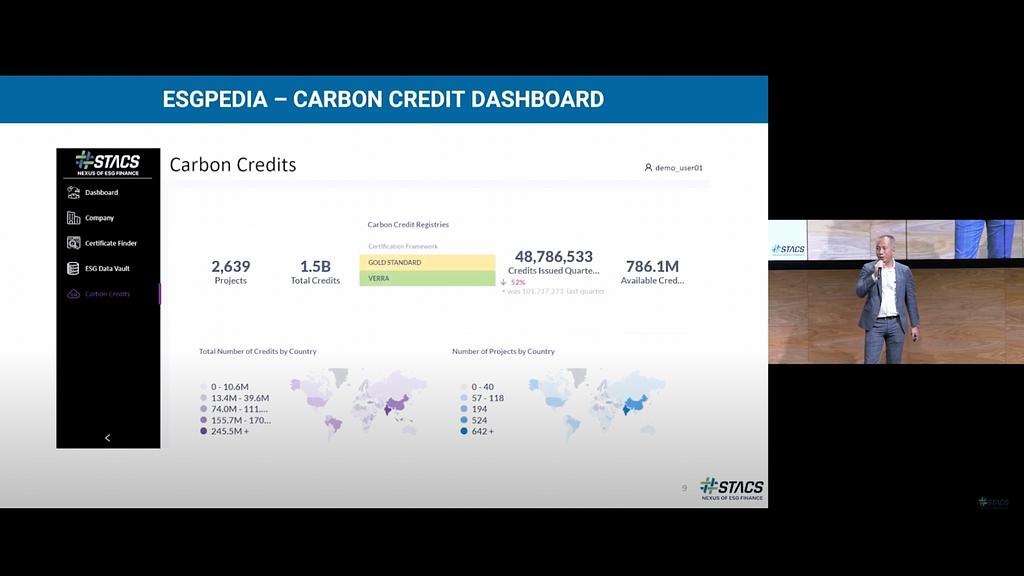

The carbon credits dashboard shows projects from different registries from all over the world with availability of supply and pricing from CME GEO futures and World Bank data.

Use cases include green and sustainability linked loans and bonds with banks, investments from fund managers, private equity, REITs, insurance products, and even carbon credits.

Playbooks for 4 key sectors — and more coming soon

We are excited to share that we have developed a selection of sector-specific playbooks to help businesses and financial services companies navigate the complex world of ESG.

For example, agriculture has a known lack of transparency in supply chains as well as a lack of data at the upstream farming stages, so we have integrated with multiple registries (i.e. ISCC, RSPO, MSPO) and data platforms (i.e. SGTraDex, GreenON, HeveaConnect) in the agri space to help solve this.

Our building and construction sector playbook takes into account the key pain point around a lack of data from day one construction all the way through to the certification stage, and then afterwards on an ongoing basis.

To help tackle this building sector ESG data challenge, we’ve integrated with global registries such as BCA, SGBC, USGBC, and BREEAM as well as data platform providers Envision Digital, Evercomm SG, and Surbana Jurong.

The third playbook we developed is for the transport sector, which will not be able to transition to electric vehicles (EVs) overnight yet lacks green certifications for much of its legacy assets.

With this in mind, we’ve partnered with CO2 Connect for carbon-emissions-per-mile-data, and we’re pleased to share that 6 corporate fleets are already working with us to set an emissions baseline and work towards improving it.

The fourth and final playbook we shared during the launch event is designed for carbon credits, which like many other assets suffer from a lack of transparency for buyers and are confused by the existence of multiple registries.

We see a strong value proposition for a common registry in the carbon credits space by consolidating various certification registries (i.e. Gold Standard, Verra, TIGR) that are complemented by integration with existing data platforms (i.e. U-Reg, Susgrid, Envision Digital).

Finally, it’s become clear that insurers operating across all these sectors will gain a better understanding of risks through ESGpedia platform data, and should be able to price products with greater accuracy as a result.

So what’s next for ESGpedia?

At STACS, we continue to work hard with our rapidly expanding ecosystem of partners to further enhance ESGpedia, to host even more data and cover more sectors on this common, standardized digital registry.

Key milestones we’re working towards include the further integration of ESG frameworks within the platform, enhanced data connectivity, and expanded playbooks across more industries (i.e. maritime, hospitality, and manufacturing).

Beyond that, we welcome partners — whether you are a company embarking on green, ESG tech provider, sectoral data platform provider, certification body, or corporate who is keen to connect with our robust ecosystem of partners — to join the platform and be enabled to contribute towards a green and sustainable legacy for Singapore and the world via holistic ESG data and technology.