High-Quality Carbon Credits and end-to-end traceability with ESGpedia can help complement your net zero strategy

Swiftly connect your existing platforms, external marketplaces, and exchanges with ESGpedia’s full open APIs connectivity layer to start using readily

REAL-TIME CONTINUOUS DATA TRACKING FROM SOURCE

Pivotal for impact reporting and monitoring of commitment, ensuring green integrity and accumulation of authentic raw ESG data

VERIFIED BY CERTIFICATION PARTNERS USING INDUSTRY STANDARDS

Provides catalyst for standardization

TAMPERPROOF REGISTRY

For storage of carbon credit information (project details, ownership, amount, audit, registry, etc)

PROVENANCE & DATA TAGGING

Enhances legitimacy of offset and prevent double spend with the use of smart contracts

FRACTIONALIZATION & POTENTIAL GAMIFICATION

Makes carbon credits accessible to companies and consumers of all sizes by lowering barrier to access

Project Greenprint

STACS’s ESGpedia is the Monetary Authority Singapore’s (MAS) Greenprint ESG Registry

Why high-quality carbon credits?

Carbon Credit

A carbon credit is a tradable instrument that conveys an entity the right to emit one metric ton of carbon dioxide or greenhouse gas equivalent.

Hiqh-Quality Carbon Credits

High-Quality carbon credits are carbon credits that are approved by from industry-recognised carbon registries (e.g., Verra, Gold Standard, etc.).

Challenges

Challenges

A myriad of carbon and ESG data registries, with some information even stored in non-digital hard-copy forms of the different carbon credits, making it hard for them to make informed investment decisions.

Consequences:

Consequences

Leads to data fragmentation, double counting, and potentially even greenwashing. Potential buyers or investors are poorly informed about the attributes of different carbon credits, making it hard to make informed investment decisions

Supporting the needs of different personas

Small & Medium enterprises

Lowered barrier with esay-to-submit ESG disclosure aligned with industry requirements

Large Corporates

Enhanced supply chain traceability to support mandatory Soope 3 disclosure

Financial Institutions

Increased ability to scale green financing decarbonize portfolios and manage ESG reporting

For Businesses

Lower barrier of entry and better monitoring of sustainability permission and emission data

Better data insights to facilitate decarbonisation efforts

Appeal to businesses and ESG conscious consumers

For Consumers

Fractionalised carbon credits are portions of a carbon credit that can be bought at an exact price.

Completed carbon credits are auditable and accounted for, preventing double counting, and quelling fears of green washing

End consumers receive a carbon certificate that is viewable in real-time on ESGpedia

For All

Everyone will have easier access to ESG Financial products. Traceable and transparent view of transaction records on the registry with access to ESG profiles of companies.

ESGpedia provides a one-stop dashboard of aggregated data from industry-recognised carbon registrie, with project attributes and line-by-line transaction transparency.

Facilitating high-quality carbon offsetting towards real positive climate impact.

Benefits of High-Quality Carbon Credits

Gain ESG insights with Data & Digital Tools to calculate, report, and verify Carbon Footprint

Monitoring of Suppliers to decarbonise Supply Chain

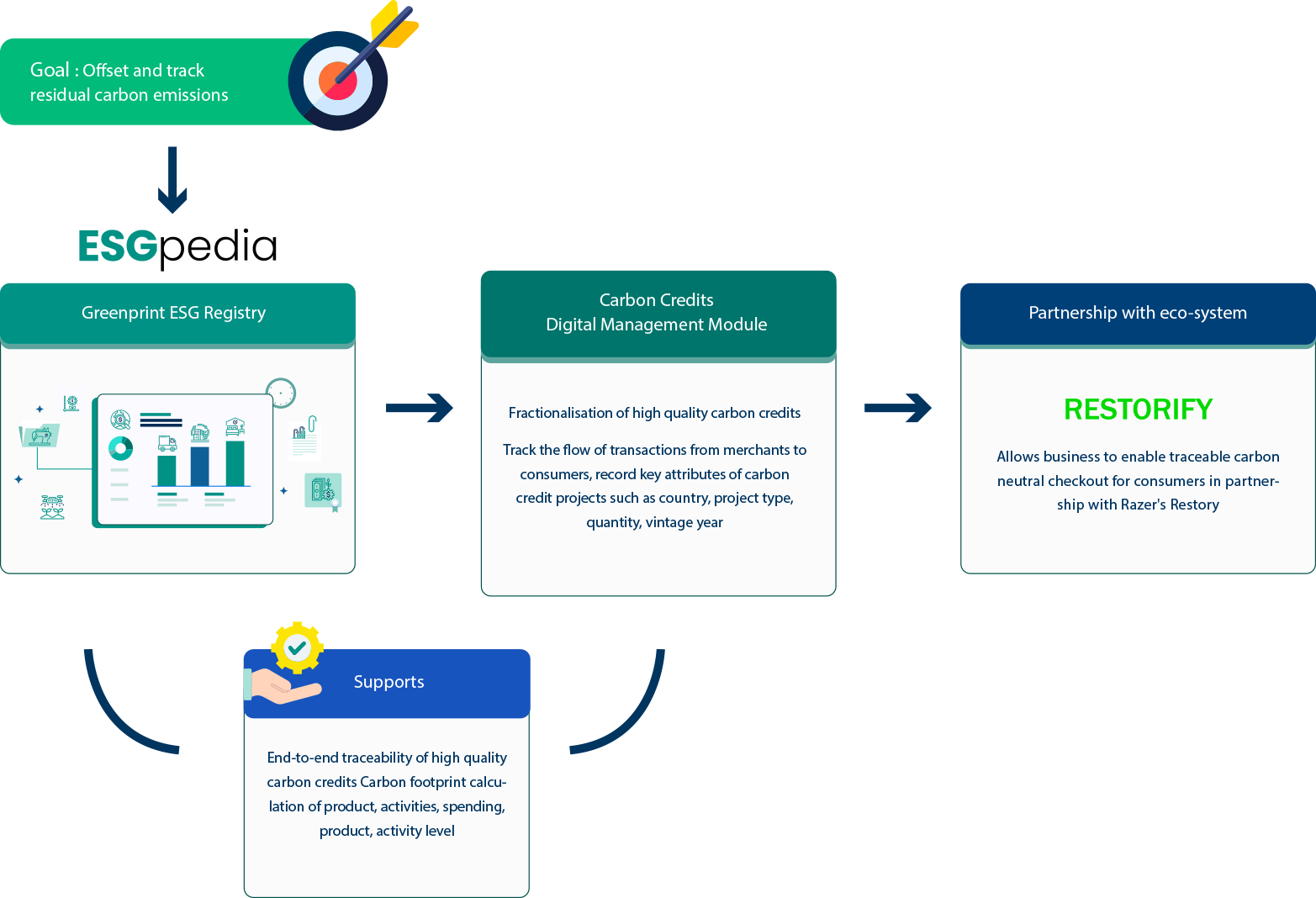

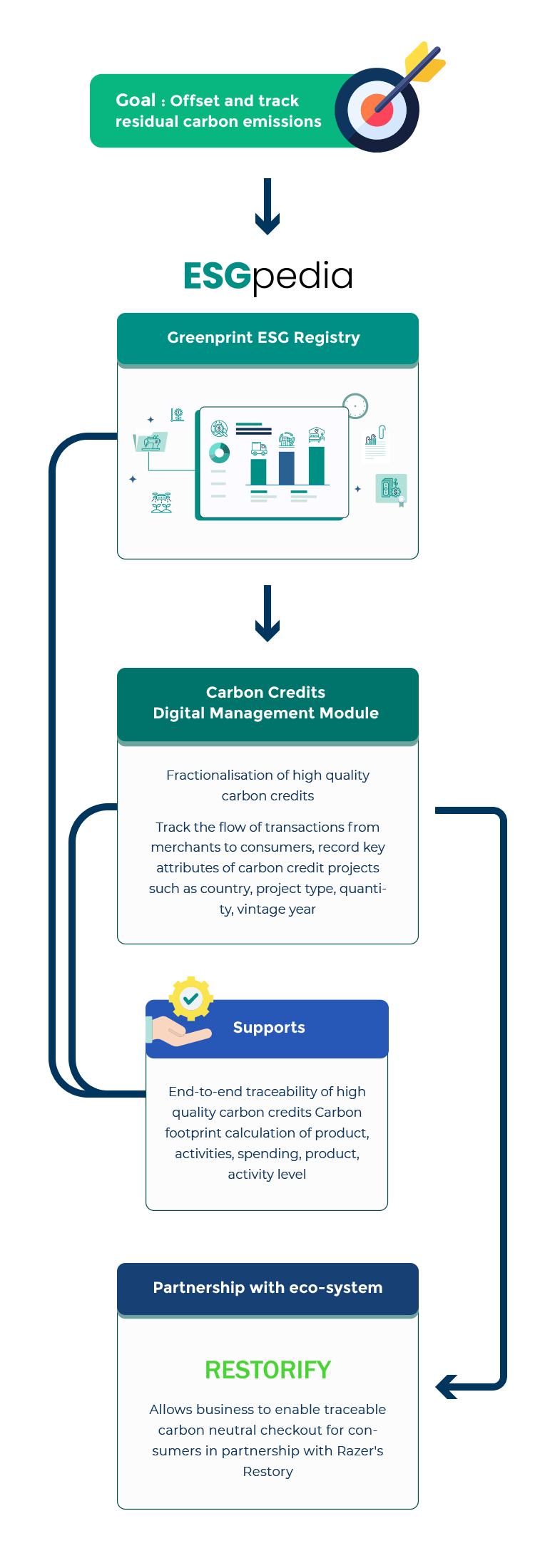

Offset Residual Carbon Emissions with End-To-End Traceability

Empower Consumers to offset with Fractionalised Carbon Credits

How we empower corporates’ net zero strategy

Case Study – Successful implementation of Tech across multiple sectors in Asia

Read our full list of Customer Stories on how STACS has successfully enabled companies across various sectors in Asia towards sustainability and net zero.

Carbon Offsets for E-commerce

In partnership with Razer, Restorify is live today, enabling Razer customers the option to make their e-commerce purchases carbon neutral, through the purchase of fractionalised high-quality carbon credits during the checkout stage to offset their carbon footprint .

Starting with the gaming industry, this solution can be scaled to other industries (e.g. hospitality, fashion, e-commerce, etc.) and all businesses with an online check-out feature to facilitate a general decarbonisation throughout the supply chain (by extending the service to partner merchants), and more importantly, enable their customers to be part of the journey towards sustainability and net zero, encouraging greater community engagement and impact.

Hear from our Partners

“The launch of the blockchain-based ESGpedia platform establishes a robust base for powering the Greenprint ESG Registry, combining STACS’ work on aggregating high quality ESG data from multiple certification bodies and verified sources, with the ability for financial institutions, corporates, and regulators to access this trusted data via a single source in accordance with their needs.”

Dr Darian McBain

Chief Sustainability Officer

Monetary Authority of Singapore (MAS)

“Singlife with Aviva is proud to be the first insurer onboard Project Greenprint. Through our partnership with STACS, we hope to create a positive impact and provide customised and potentially cost-saving solutions for customers who successfully reduce their carbon footprint.”

Pearlyn Phau

Group CEO

Singlife with Aviva

SEEING IS BELIEVING

Book a 30 minutes demo to see STACS in action and discover how your company can unlock massive value in ESG data and finance.

Gartner Eye on Innovation

Award for Financial Services 2020

Mercury – Asia Pacific Winner

FSTI Grant 2020 by MAS

Two-times awardee

DigFin Innovation Awards 2021

Best FinTech ESG Solution

Monetary Authority

of Singapore (MAS)

Global Fintech Innovation

Challenge Award 2020

UBS Future of Finance

Challenge 2019

Global Finalist

Project UBIN led by MAS

Technology Partner

Mastercard

Start Path

Blockchain firm