Supported by SFA, held together with speakers from Deloitte, HSBC, PwC, Standard Chartered, co-located with SFF x SWITCH:

Delivering real content and showcasing live applications of Capital Markets’ digital securities

We held an official #STACS Blockchain Event during SFF x SWITCH week, together with established institutions championing DLT’s digital transformation effects.

Highlights Included: An exclusive live session of managing securities on the STACS blockchain, together with discussions about Banks taking up new technologies and DLT findings straight from the world-renowned Deloitte’s APAC Blockchain Lab.

Here’s what happened: Deloitte, HSBC, PwC, Standard Chartered and #STACS keynote speakers came together as an insightful lineup for —

- Live Case Studies of digital transformation for banks, exchanges and the financial ecosystem

- STACS Blockchain’s applications in securities and asset management

- Leveraging new technologies to optimise the traceability of data and assets

Highly relevant to financial institutions including Banks, Stock Exchanges, Broker-Dealers, Funds, Fund Administrators, together with Consultancy firms, Regulators, National agencies and associations

Managing Director of STACS, Jay Ng: How does the STACS Blockchain build a Blockchain-Based Ecosystem around Financial Markets?

The DLT Ecosystem

• How can we build the ecosystem: within a large organisation, across borders and with strategic market players?

• How is the STACS Blockchain designed specifically for financial institutions?

Key take-aways from established experts in the field:

Rajeev Tummala, HSBC Global Banking and Markets, Senior Vice President looked at addressing Conway’s Law with DLT.

Blockchain in Banking:

• How are the banks moving forward with blockchain digitisation and new technologies, together with fintech firms such as STACS with technological expertise?

• Blockchain applications, benefits and insights for clearing and settlement

Dr Paul Sin, Deloitte Consulting Partner with Deloitte China and Deloitte’s Asia Pacific Blockchain Lab Leader

DLT Applications in Post-Trade processes:

•Post-trade DLT live cases Deloitte has advised on and post-trade case scenarios which deeply benefited from blockchain.

•The opportunities and challenges facing post-trade, e-KYC, challenger banks, corporate banking, funds, along with the relevant tech architecture.

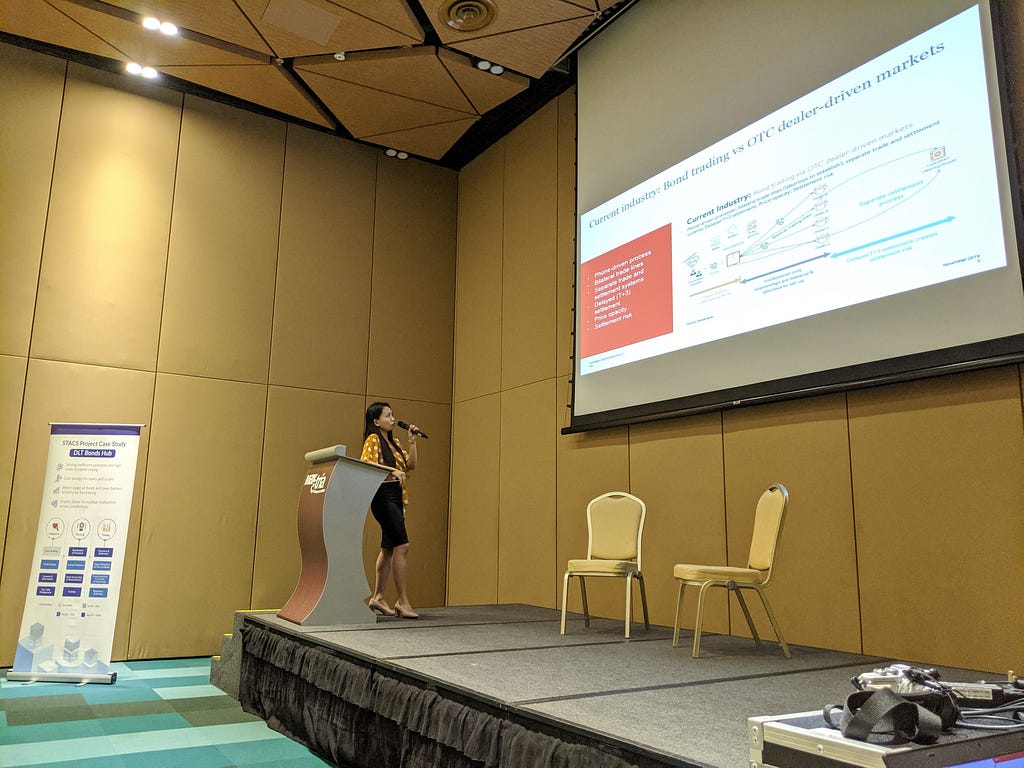

Wong Wanyi, PwC Partner

DLT Applications for the Bond Markets:

- What are the traditional flows of asset structuring, such as for bonds, and how can blockchain benefit them?

- What are the Blockchain applications on securities such as bonds?

- What are the Blockchain application on asset management — in areas of the lifecycle management in reporting, enterprise data management and better traceability.

From PwC Ventures Hub, Wong Wanyi dives deep into the bond markets. As a knowledgable FinTech leader empowering females, she holds deep capital market expertise and looks at the current industry between bonds trading and OTC dealer-driven markets. Wanyi expertly shares how a shared, trusted view of asset information will also enable faster settlements, cutting operational costs and complexity.

Fireside Chat: John Ho, Standard Chartered, Managing Director, Head of Legal

John Shares About Regulatory Trends and Challenges in DLT:

- What are the regulatory trends in different jurisdictions?

- What are the implications and findings from previous DLT projects?

Lim Chuanji, Senior Manager of Partnerships of STACS: Challenges faced by financial institutions in their DLT Strategies, Trends & Insights

STACS gains digital transformation insights on the region’s fintech landscape and trends of new technologies on fintech innovation in Capital Markets.

Based on market feedback from STACS engagements with 150+ financial institutions, we gather insights regarding the challenges faced by financial institutions in DLT strategies.

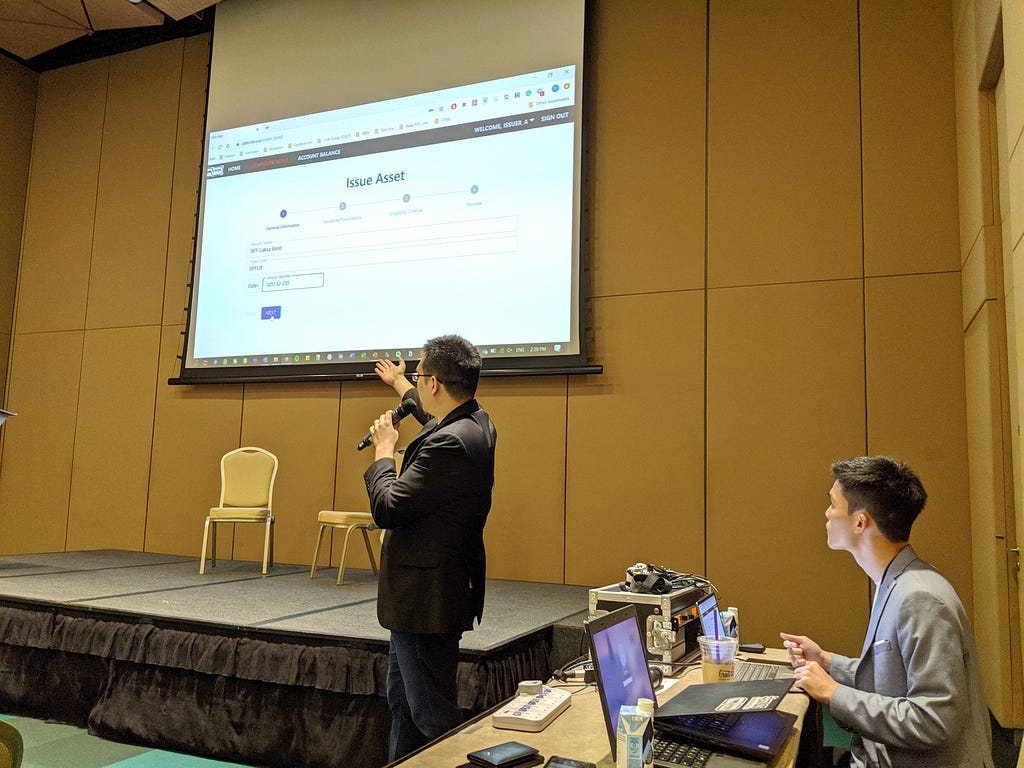

Live Demonstration from STACS: Nigel Lam, Senior Manager in Product & Jin Ser, Solutions Architect Director

STACS integrates Capital Markets with Project Ubin Payments Network

- An interactive experience of blockchain-based securities for the market participants

- The full lifecycle management of securities is enabled on STACS Blockchain with instant DvP cross-chain

Together, STACS Has Achieved A Major Milestone for DvP — Announced at Singapore Fintech Festival (SFF)!

During the workshop, Capital Market audience received first-hand insights of blockchain tech being utilised in live capital market case studies.

They witnessed the novel, world-first innovative way to safely issue, trade, settle and clear assets on the STACS blockchain in real-time.

###

About STACS

STACS is a Singapore-based Blockchain development firm focusing on the digital transformation of the financial industry. Our flagship product, the Securities Trading Asset Clearing and Settlement (STACS) Network, is a blockchain built specifically for Finance. Our vision is to be the underlying Distributed Ledger Technology on which Financial Market Infrastructure is built upon.

Written by Hashstacs Pte Ltd: Isabelle Sumarli, Business Development Manager

We read every response here or on Linkedin and Twitter