How Data Can Enable High-Quality Carbon Credits for Sustainability: Breaking Down to Each Persona

A wave of green is sweeping through the economy. Everywhere, businesses of all sizes – from neighbourhood mom-and-pop shops to large corporates like BlackRock – are recognising the significance of sustainability as a core consideration for long-term economic success. An increasing number of them have also begun putting in place measures to make their business operations more sustainable.

Since the global phenomenon which some term the “green awakening”, the buzzword on the lips of politicians, business leaders, and climate experts seems to have been ‘decarbonisation’. In short, decarbonisation refers to, “(the) removal or reduction of carbon dioxide (CO2) output into the atmosphere”, according to an article published by Deloitte. Typically, methods to carry this out are known as decarbonisation ‘levers’, some of which include improving efficiencies in energy usage as well as replacing fossil fuels with renewable sources of energy.

Limitations of Existing Measures

In spite of the enforcement of regulations and companies’ best efforts at decarbonisation, carbon emissions remain inevitable for some businesses, especially those in carbon-intensive industries such as the Transportation and Logistics sector. Known as residual emissions, they are a result of limitations in current technology and prohibitive costs which restrict the ability of companies to fully eliminate greenhouse gases (GHGs) from being produced.

If GHGs are still being released into the atmosphere despite our best efforts, is the quest for carbon neutrality and net-zero merely a pipe dream?

Carbon Credits: The stepping-stones to Net-Zero

Evidently, that is not the case. How, then, can we get to net-zero? Perhaps non-profit organisation Carbonfund.org’s tagline puts it the best: “Reduce what you can, offset what you can’t”.

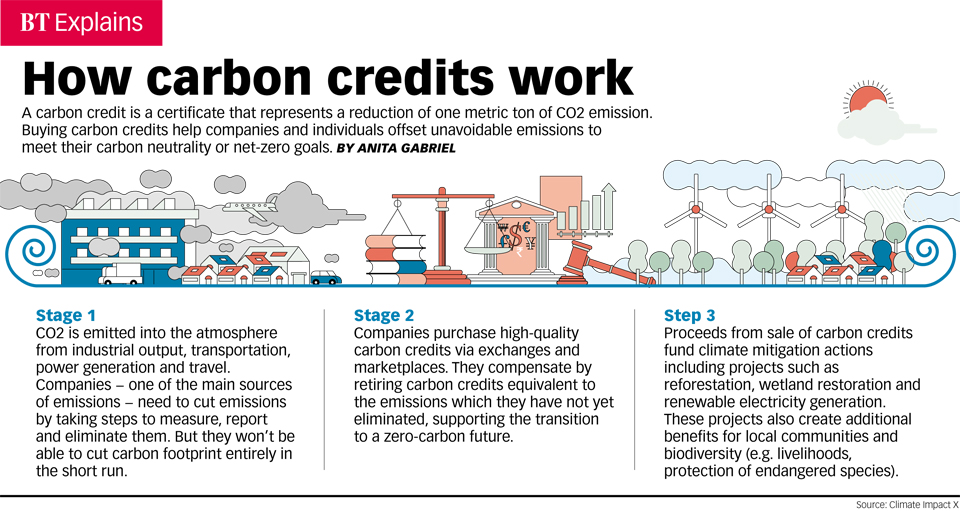

Source: Business Times

Carbon credits offer businesses the opportunity to offset their carbon emissions while they take steps towards net-zero. According to a publication by PwC, a carbon credit is a tradable instrument that conveys an entity the right to emit one metric ton of carbon dioxide or GHG equivalent.

Currently, there exists both the compliance carbon market, where companies purchase carbon credits to offset their residual emissions in order to meet their mandated GHG emission reduction goals, and the voluntary market, where companies purchase them on their own accord to reduce their carbon footprint and communicate their corporate social responsibility. Companies can purchase these credits from carbon offset projects, which range from reforestation efforts that sequester carbon from the atmosphere and stores them in trees, to initiatives that help communities transition to renewable energy sources – such as solar or wind power.

Carbon credits that fulfil the 5 criteria of being real and measurable, permanent, additional, independently verified, and unique and traceable are deemed ‘high-quality’. Projects are assessed by independent third-party verifiers, who base their assessment on standards set by reputable organisations such as Verra and Gold Standard.

Additionally, carbon credits offer businesses in the compliance market for carbon an additional revenue stream. When these companies emit less carbon than their emissions allowance, they are able to sell these excess credits to other firms who may still be producing above their emissions allowance. As a result, companies are incentivised to reduce their carbon emissions for greater profit – seemingly a win for both environment and economy.

The Issue with Carbon Credits

Yet, while carbon credits are deemed by some as an indispensable instrument in the transition to a net-zero economy, others view them as outright greenwashing – a mere PR stunt businesses pull to quell investors’ call for greater climate action and social responsibility. A few core issues currently plague the market for carbon credits.

Poor Systems for Monitoring, Reporting, and Verification

Firstly, there is a lack of digital infrastructure to facilitate the Monitoring, Reporting, and Verification (MRV) process for carbon credit projects, leading to a lack of transparency and doubt over the real impact of carbon trading. For instance, a report by Nikkei Asia estimated that about 40% of carbon credits sold on the marketplace are over 5-years old, casting doubt over aspects of their quality, such as their permanence. Because of the lack of data, investors and other stakeholders are also unable to verify the transactions undertaken by businesses, such as whether the carbon credits purchased have been duly retired to meet emissions targets, giving rise to issues such as double-counting and hence, greenwashing.

Currently, there also exists a long lead time for projects to be assessed, verified, and then approved for the generation of carbon credits. Kimberly Lee, Strategy and Business Development Manager at STACS, also added that “there exists a great opportunity for technology to play a role in streamlining the process of data collection of these projects, easing the MRV process” – something that the industry has perhaps not tapped on enough yet.

Data Fragmentation across the Market

Lee also mentioned that data fragmentation is another core issue plaguing the carbon market, stating that “there are just too many registries”. Currently, even when companies disclose their climate-related data, they are often stored in a plethora of different registries, and even sometimes exclusively in hard-copy forms. Such data fragmentation may lead to cases of double counting and potentially encourage greenwashing, leaving stakeholders such as potential buyers or investors “not as informed about the attributes of the different carbon credits available to them”. This ultimately makes it harder for them to make sound and savvy investment decisions.

Lying below the surface of all these problems, however, is the issue of high-quality, forward-looking data that is sorely needed, yet missing from the market for carbon credits.

What Good Looks Like

In order for countries and businesses to truly harness the full potential of carbon markets for climate change, greater transparency and traceability in the market is required. One solution that has been mooted is the application of digital technology to allow for all carbon transaction data to be displayed on a single registry – something that STACS’s AI-powered ESGpedia platform offers. Such application of data, through technology, unlocks different possibilities for different personas along the carbon credit value chain.

For Project Developers and Verifiers

Improvements in digital infrastructure for data disclosure would afford greater efficiencies for carbon offset project developers and corporates looking to commodify their carbon credits.

Adoption of advanced monitoring systems such as sensors would not only provide a more robust data acquisition methodology and measure emissions reductions more accurately, but also afford project developers and verifiers greater efficiency as opposed to current methods, where data is still collected manually.

Currently, STACS is partnered with players in this space to help improve the accuracy of measurement. The emissions reduction data collected through these means are then aggregated and streamlined onto the ESGpedia platform, providing buyers with greater data accessibility.

For Corporates

Better systems for data management would benefit corporates by enabling better monitoring of their own emissions data. As such, this opens up opportunities for improvements in their decarbonisation efforts, as well as the potential to generate a secondary source of income through the sale of surplus carbon credits.

For Green Service Providers

While indirect, the issues with data and current inefficiencies in carbon markets present green service providers opportunities they could possibly tap on. One notable initiative is that of the World Bank’s Climate Warehouse program, targeted at creating a global, common registry of multiple registries. Such an initiative would serve to prevent double-counting, and enhance the transparency of cash flows and emissions disclosures.

Ultimately, what is achieved is greater trust and confidence in carbon markets, encouraging more corporates to participate, leading to greater investments in decarbonisation projects and lower overall net GHGs produced.

For Investors

A common, standardized digital registry for emissions data would arguably benefit investors the most by overcoming the issues of data inaccessibility and unavailability. Stakeholders looking to invest in carbon credit projects, such as asset managers, often require ongoing, forward-looking, and aggregated data that covers various sectors and geographies to base their investment decisions upon. Yet, current emissions data are either only released periodically, or only available to privileged institutions. The provision of such data on a single registry would enhance these asset managers’ ability to make better-informed carbon investment decisions.

As mentioned earlier, better, more forward-looking data could also one day enable investors to determine for themselves, according to standards set by reputable organisations such as Verra and Gold Standard, whether certain carbon credits are high-quality enough to be purchased for carbon offsetting – creating a definition of ‘high-quality’ not governed by one single source, but agreed upon by all. As a result, more companies and investors would be able to access more carbon credits to offset their emissions, leading to lower net overall carbon emissions.

For Individuals

The ideal carbon market we envision for the near future is one where not just corporates and big players, but also individuals and end consumers are able to have access to and afford the purchase of carbon credits, per their level of carbon footprint or interest.

This lowered entry level to the carbon markets can be made possible at scale with digital technology – on top of allowing traceability and ongoing monitoring, tokenization of carbon credits offers the flexibility of fractionalised carbon credits, which is a portion of a carbon credit that can be bought at an exact price, rather than having to round up or down to the nearest complete carbon credit. This allows for affordability, while at the same time ensuring that the complete carbon credits are still auditable and accounted for, without the occurrence of double counting.

The digital registry is also able to provide individuals with transactional transparency, by immutably storing every single transaction of fractionalised carbon credits line by line – something that existing solutions in the market are currently missing – and yet at the same time, offer interoperability to connect with the various industry-recognised carbon credit registries globally (i.e. Verra and Gold Standard) to achieve an end-to-end transparent link from origination to retirement.

When fractionalised carbon credits become widely available and adopted – a scenario that is currently more aspirational, but soon-to-be reality – access to holistic data on a common, standardized registry would be ever more important in levelling the playing field for both institutions and individuals in making well-informed carbon investment decisions.

Conclusion

As the global climate agenda continues to speed up, what is truly needed to solve the issues at hand is apparent – better data for a better planet.

PRESS CONTACTS

If you are a journalist with media queries, contact us.