Capital Market Use Case: ‘Smart’ Bonds

How does STACS support innovative projects in the bond industry?

How does STACS support innovative projects in the bond industry?

How Is STACS Blockchain Technology Solving

Pain Points and Creating Opportunities?

Pain Points

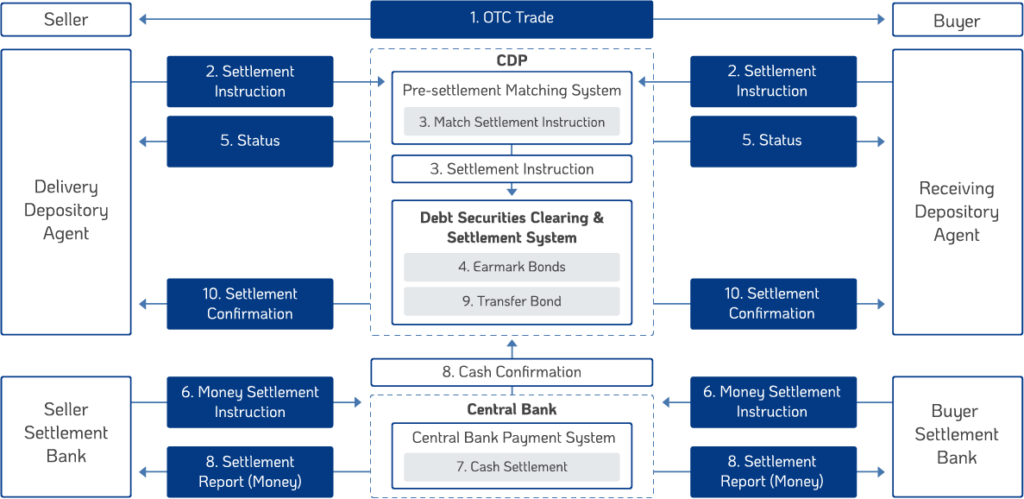

Costly and inefficient technological infrastructure

Manual business procedures and bond distribution processes

The usage of physical instruments and scrips give rise to the tendency of fragmented markets and low liquidity

Opportunities

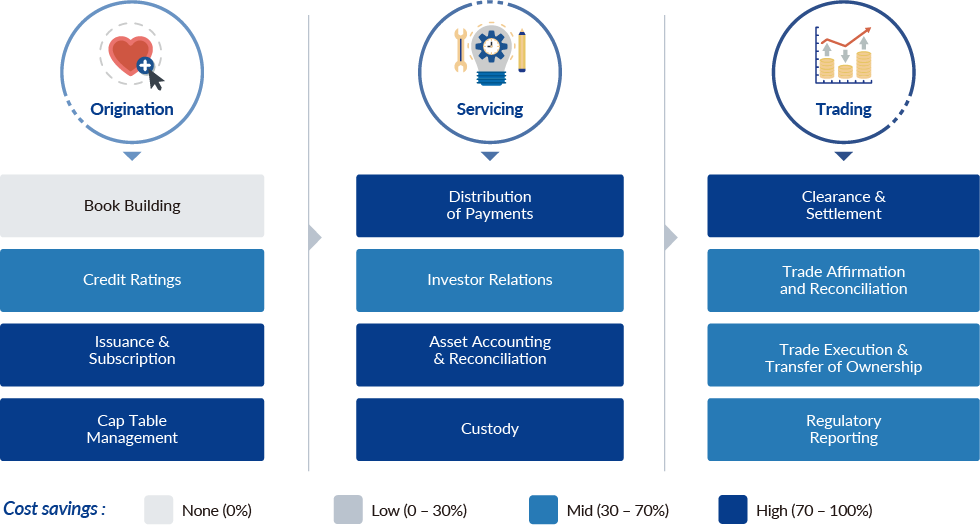

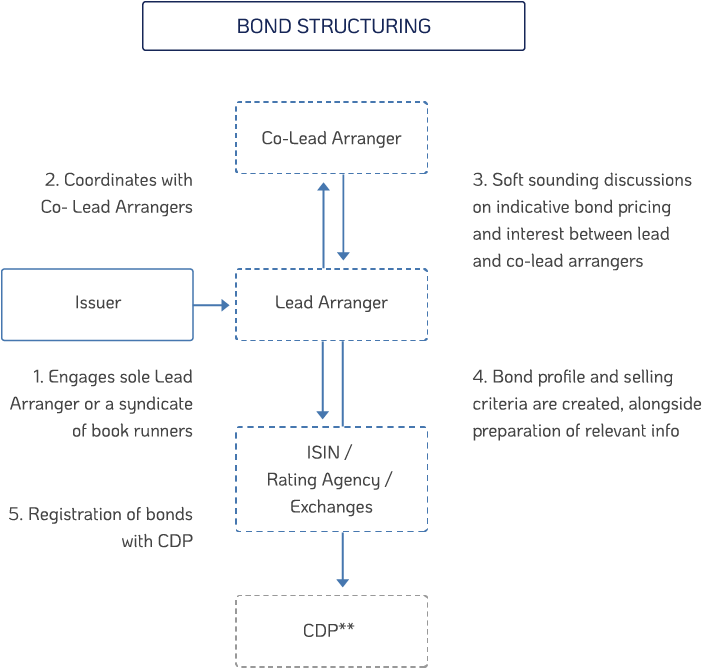

Digitise the bond issuance process

- Cost savings for Banks with digital journey

- Savings passed-on to issuers for more efficient use of funds, lower barriers to entry

- Greater efficiencies downstream in the asset lifecycle

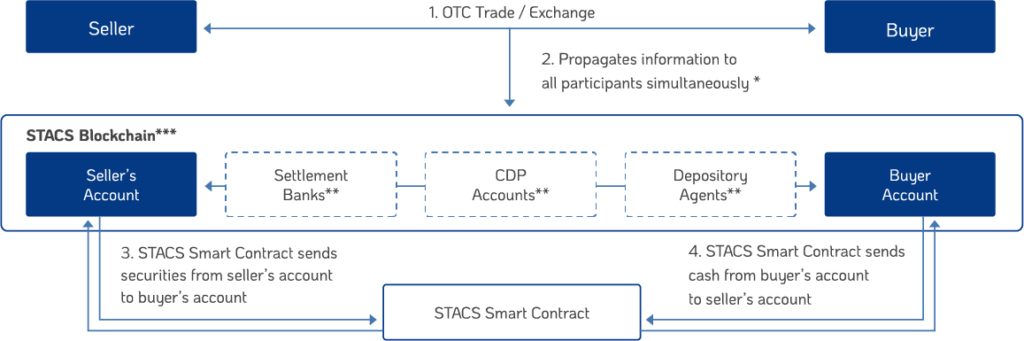

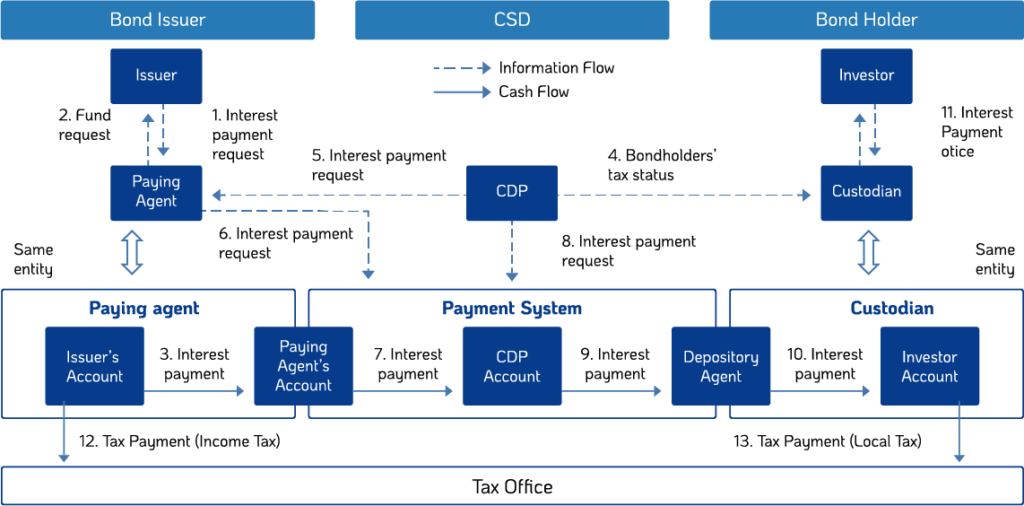

Highly automated distribution processes, such as repayments and redemptions, through smart contract usage

- Form an integrated hub with cross-border listings and trading of digital bonds, for new and efficient markets

- Better usage of funds and lower barriers to fundraising

Learn More About Our Work

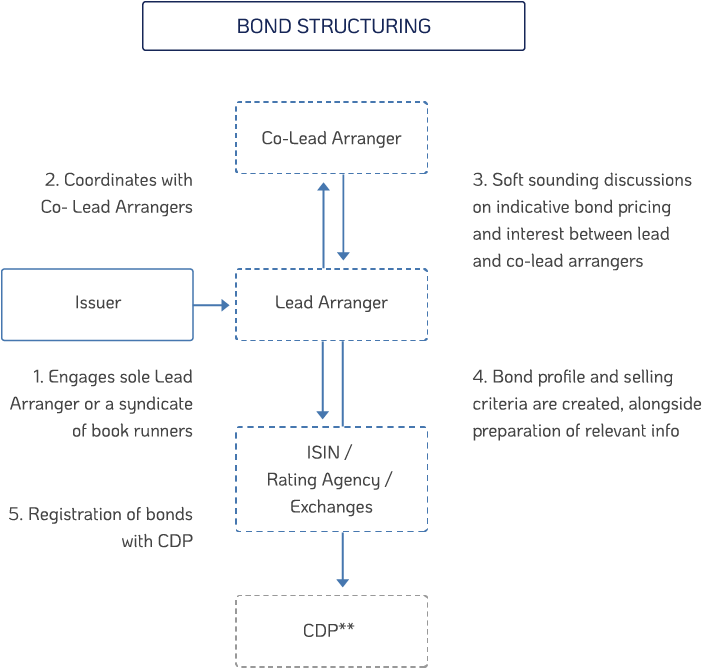

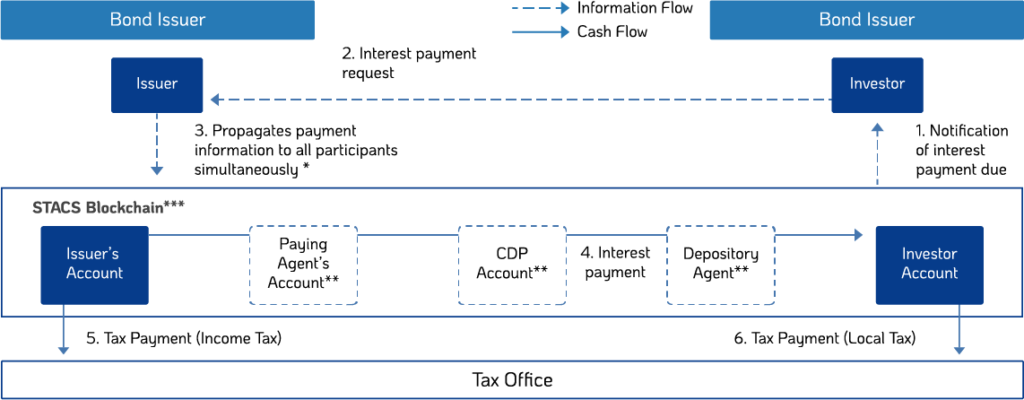

* No reconciliations / checks required due to ubiquity of shared ledger information

** Settlement Banks, Transfer Agent and CSD able to fulfil value added functions, and not just a legal and notary requirement.

*** Blockchain and smart contract removes need for duplication of multiple reconciliation actions and allows for straight through processing

* No reconciliations / checks required due to ubiquity of shared ledger information

** Paying Agent, Transfer Agent and CSD able to fulfil value added functions, and not just a legal and notary requirement

*** Blockchain and smart contract removes need for duplication of multiple reconciliation actions and allows for straight through processing