STACS: A Fintech Firm That Empowers Financial Institutions to Enter the Digital Market by Building Enterprise Blockchains

In a Nutshell: While many tech startups have embraced blockchain technology from the start, traditional financial institutions have not always been in the position to do so. The STACS Network is helping these institutions enter the digital marketplace by integrating blockchain into existing systems. The team behind the STACS Blockchain has years of experience in the fintech sector and leverages this expertise to position the platform and its clients to be at the forefront of blockchain technology. In one of its highest-profile use cases, STACS is an integral part of Singapore’s Central Bank Digital Currencies project, Project Ubin.

The fintech marketplace is rife with young startups that have built their platforms and business models from the ground up to be blockchain-friendly, or even blockchain-based.

Meanwhile, some traditional financial institutions are struggling with strategies and implementations of how to enter this new, decentralized marketplace of digital currencies. While these institutions have decades of experience working with legacy systems and fiat currencies, many simply don’t have the infrastructure or expertise to compete in the digital marketplace.

The STACS Network is a Singapore-based fintech firm specializing in building enterprise blockchains for capital markets to help bridge this gap.

“As most financial institutions are using legacy technologies and systems, STACS blockchain is thereby transformational to capital markets,” said STACS Managing Director Jay Ng of the company’s core product. “It helps our clients to save time, money, resources and improve their efficiencies significantly.”

Ng said that he began his career in finance as a trader and investment professional before taking a career break to pursue his post-graduate degree at University of Cambridge on a Monetary Authority of Singapore (MAS) scholarship. Upon his return, he started to build STACS to tap into Singapore’s thriving fintech sector.

He noted how the creation of new product ranges, existing operational efficiencies and services could be improved upon, particularly to meet the needs of an international financial hub with access to the capital markets.

“STACS was inspired by the vision to make access to resources much easier for existing financial institutions, with global connectivity and new revenue opportunities,” Ng said.

How Traditional Financial Institutions Fit into the STACS Blockchain Ecosystem

“STACS is designed for financial institutions,” Ng said. “We protect confidentiality, ease of use and compliance with regulatory requirements.”

In fact, the platform’s stated vision is to aim to be the global standard for digital securities, as the underlying financial market infrastructure.

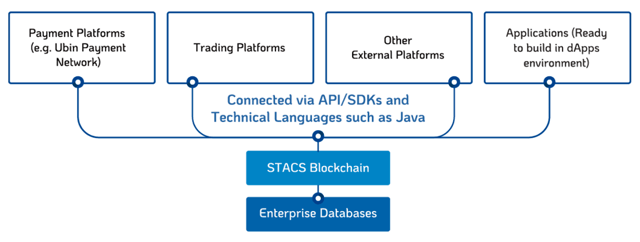

“The STACS Network empowers financial institutions by providing them a functional, yet user-friendly enterprise blockchain, to implement Distributed Ledger Technology (DLT) strategies effectively, without creating inefficient silos and segregated systems,” Ng said. “And equip them for the digital evolution in the financial industry with our abilities in integration with systems.”

He said STACS’ products are ready for immediate use and the company has live clients currently using its fintech solutions in real time.

STACS is built to easily integrate into legacy systems in traditional financial institutions.

“The types of clients that are working with us include stock exchanges, local and international banks, asset management firms, and others all around the world,” Ng said.

As a blockchain built specifically for finance, STACS is actively integrating with legacy systems, the Managing Director said. This allows its clients to plug-and-play almost instantaneously.

“Our active integration to finance legacy systems is due to our position as a finance blockchain specialist,” Ng said.

With the STACS suite of technology for capital markets, STACS can cater solutions to fit the entire securities lifecycle, according to the company website. A near real-time book-building and process can be done.

Clients also get reduced time to market for issuance and the cost of issuance decreases with lesser third-party intermediaries.

Additionally, the Digital Identity feature on STACS Blockchain allows financial institutions to perform KYC/AML verifications during securities issuance and secondary trading much more efficiently, according to the company.

A Team Focused on Delivering Great Customer Experiences by Working Closely with Clients

Ng said the STACS Network team, whose members have years of experience in the financial industry, is well positioned to help clients succeed. The team’s extensive background is part of what led to the formation of the company to begin with.

“This led them to think about marrying their knowledge and experience on current problematic areas in traditional finance with blockchain technology,” he said.

Jay Ng is the Managing Director at the STACS Network.

The company also seeks feedback from its clients and potential clients to help understand how it can have the most impact.

“STACS had conversations with more than 200 financial institutions around the world, who told us about the regular problems faced in implementing blockchain, legacy, migrating issues,” Ng said. “We listened to their needs, eg. blockchain to scale for full business production (beyond Blockchain proof of concept and established business use cases), speed to market, interoperability and built for regulatory requirements.”

He said the company’s plug-and-play solutions help clients save substantial amounts because they don’t have to reinvent their models or develop new systems from scratch.

“We also collect feedback on a daily basis through our close interaction with the industry,” he said. “We also co-develop solutions, working hand in hand with financial institutions to solve their pain points.”

He said the ecosystems STACS is building starts with what he calls a Minimal Viable Ecosystem where “a few critical institutions come together to play various roles and to demonstrate viability. Each of these ecosystems can grow into an industry-wide solution.”

The impact of these ecosystems and solutions are great for the industry as a whole.

Ng said examples of current projects include the bonds issuance sector and life cycle management, smart-structured products, trade life cycles of exchange-traded derivatives and traditional stock exchanges using blockchain technology.

A Partner in Singapore’s Landmark Digital Money Project

One of STACS’ most significant and notable use cases, Ng said, is its integration with Singapore’s Central Bank Digital Currencies project, also known as Project Ubin.

“The project aims to help MAS (Monetary Authority of Singapore) and the industry better understand the technology and the potential benefits it may bring through practical experimentation,” according to the project website. “This is with the eventual goal of developing simpler to use and more efficient alternatives to today’s systems based on central bank issued digital tokens.”

In its role, STACS focuses on how to effectively bridge various blockchain platforms while harnessing the full potential of each of the respective platforms, Ng said.

“In line with this, STACS has developed instant processing and settlement capabilities of various digitised securities (digitized versions of traditional equities, bonds, and foreign exchange currencies) on the STACS blockchain, and integrated with other blockchains,” he added.

The company’s involvement with Project Ubin paves the way for the industry’s progress in pursuit of instant DvP (Delivery versus Payment) of securities against currencies through applied blockchain, according to the company.

“With more blockchain adoption in the capital markets, STACS is in a strong position to serve as a bridging solutions partner,” the Managing Director added.

Project Ubin is a sweeping multiyear, multiphase project, according to the project website. Each phase is aimed at solving pressing challenges faced by the finance industry and the blockchain ecosystem. The project is currently in its fifth phase.

Ng said that, as far as the future of The STACS Network, the company plans on continuing to innovate in the realm of blockchain.

“We are constantly developing our blockchain technology for new and enhanced features, such as fraudulent transactions detection, data privacy/protection, etc.” he said. “We are also focused on eliminating all the tedious manual processes that are currently still used in the financial industry.”

Originally written on https://www.cardrates.com/news/stacs-facilitates-enterprise-blockchains-for-finance/

Editorial Note: Opinions expressed here are of the original author’s alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

About STACS

STACS is a Singapore fintech development company focusing on the digital transformation of the financial industry. Today, our clients and partners such as stock exchanges, banks, asset management firms etc are using our proprietary Securities Trading Asset Clearing and Settlement (STACS) Blockchain for various use cases while working together with their ecosystem participants to enjoy efficiency savings in operations and to create new revenue streams.

For Enquiries

[email protected]

Website

www.stacs.io