STACS featured by The World Economic Forum — Insight Report — Digital Assets, Distributed Ledger Technology, and the Future of Capital Markets

STACS is featured in the May 2021 The World Economic Forum report, as one of the few live DLT platforms for effective Trade Lifecycle Management for the financial industry.

Download the full insight report here.

This report highlights the results of a series of virtual global workshops and expert interviews held with financial services and technology experts in 2020. It looks at the urgent need for digital transformation in capital markets, with a view to providing strategic insights that will improve client service delivery, achieve greater efficiency and enable new services.

As well as exploring the use of distributed ledger technology (DLT) — now going live in many institutions– and its role in future capital markets, it examines the challenges involved in attempting industry-wide transformation and presents a framework for different approaches to DLT solutions. Finally, it presents a use case analysis of seven asset classes/product lines, including equity markets, securitized products, derivatives and securities financing.

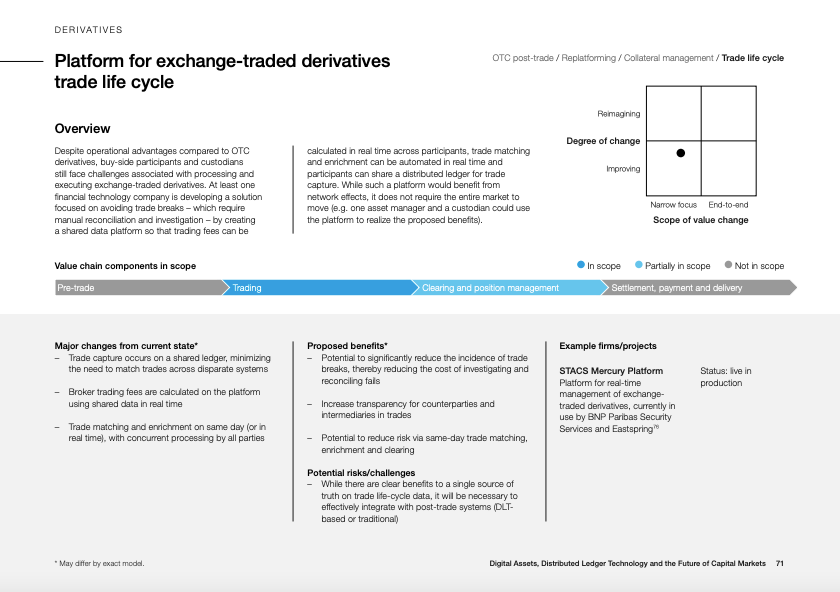

The section (on page 71) breaks down our award-winning Real-Time Synchronized Trade Processing solution that has been successfully deployed live with leading global financial institutions like BNP Paribas and Eastspring Investments since June 2020.

In collaboration with Eastspring Investments, our solution was awarded Asia Pacific Winner in the Gartner Eye on Innovation Award for Financial Services 2020.

By providing a common industry-wide platform for asset managers, brokers, and middle offices, our live solution empowers financial institutions to manage trades in an instantaneous, distributed, concurrent, and error-free process, with a proven 96% elimination in trade breaks, minimising costly risks and unlocking balance sheets and opportunities for the leading global financial institutions onboard.

Read our joint Press Release with BNP Paribas and Eastspring Investments. You can also watch the live showcase of our solution with our partners Eastspring Investments and BNP Paribas during the inaugural STACS Showcase, in conjunction with Singapore FinTech Festival 2020 here.

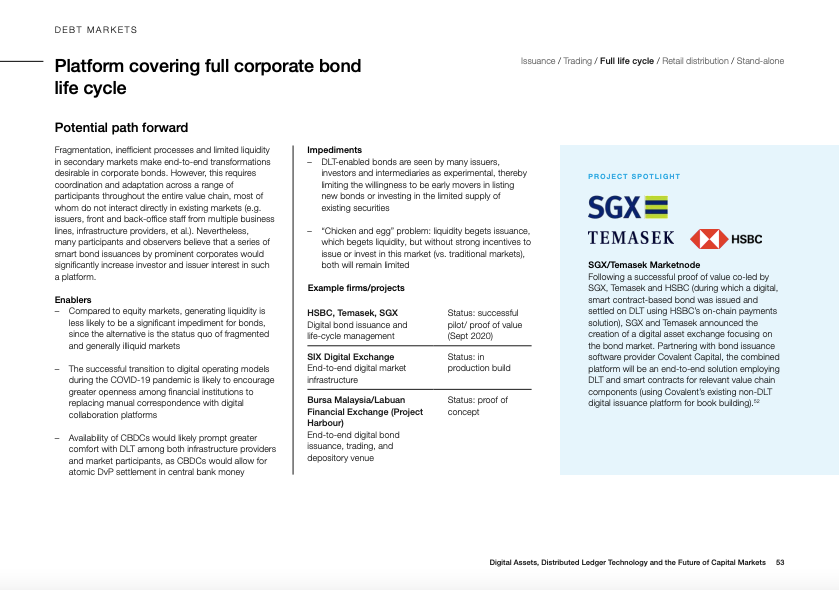

The section (on page 53) features Project Harbour, our end-to-end Bonds in a Box solution collaboration with Malaysia’s National Stock Exchange Bursa Malaysia. Project Harbour was awarded Best Blockchain Project in the renowned The Asset Triple A Digital Awards 2021.

Earlier in December 2020, STACS successfully completed our blockchain project with Bursa Malaysia to facilitate the growth of the bond marketplace at the Labuan Financial Exchange (LFX).

Together with China Construction Bank Labuan, CIMB, and Maybank, STACS’ live institutional Bonds in a Box platform was utilised to mirror bond templates onto smart contracts for rapid deployment, while streamlining operational workflows to increase efficiency and flexibility in settlement cycles. Overall, the project proved the value of an end-to-end industry platform for issuance, trading, settlement and depository of bonds for all market participants.

Read our Press Release with Bursa Malaysia.

Once again, you can download the full insight report here. Connect with us to request for a demo, and sign up for a free trial of our platforms to unlock value and discover new opportunities for your institution via STACS Studios today.