Financing SMEs for Sustainability – How to set KPIs to attain Sustainability-linked loans?

The Sustainable Finance Landscape

The shifting paradigm within the world of finance in recent years has been attributed to the emergence of sustainability linked loans within the burgeoning sustainable finance landscape. While the supply of green loans has remained relatively ‘static’, the issuance of Sustainability-linked loans has sky-rocketed, reaching $350 billion in the first six months of 2020 in the US.

With SMEs making up 90% of global businesses, they play a pivotal role in being key suppliers to businesses and in turn, the decarbonisation of global supply chains (Scope 3 emissions). With rising regulatory pressures and awareness, SMEs are increasingly expected to decarbonise to remain competitive. To actively take steps to manage their GHG emissions through decarbonisation strategies and energy transition measures, SMEs need access to the necessary green capital, which can take the form of sustainability-linked instruments.

Within this dynamic landscape, sustainability-linked loans have surfaced as the bedrock of rapid growth. The transformative potential of sustainability-linked loans as a conduit through which businesses align economic pursuits with ethical imperatives is captured by Mallory Rutigliano, a sustainable finance associate at BNEF, as she notes, ‘Bonds and loans don’t even need to be earmarked for specific purposes, which allows companies to integrate their corporate sustainability targets into all kinds of financing.’

Types of Sustainability-Linked Finance

Sustainability-Linked Finance is a dynamic collection of instruments designed to drive sustainability for businesses across various sectors.

Green Bonds assume a prominent role, channelling capital exclusively into projects that promise positive environmental impacts, such as initiatives revolving around renewable energy. A striking departure from traditional bonds, conversely, are Sustainability-Linked Bonds (SLBs). These instruments tie the interest payments to the issuer’s successful attainment of specific sustainability objectives, adding an intriguing layer of accountability.

Alas, the true versatility of sustainability-linked finance comes to the fore with sustainability-linked loans. Sustainable-Linked Loans capitalize on the concept of linking loan terms and interest rates to pre-established sustainability targets. This approach not only incentivizes businesses- regardless of size – to enhance their ESG performance, but also offers a dynamic mechanism for positive change. Banks are pivoting their attention towards sustainable financing for SMEs, with OCBC witnessing a 50% year-over-year surge in lending amounts to SMEs for sustainable projects, reaching a commendable sum of over $3 billion by the close of 2022.

Sustainability-linked loans are not to be confused with green loans. The latter is tied to financing environmentally friendly ventures but may lack the nuanced flexibility necessary for businesses, especially SMEs, to holistically advance their ESG performance. This is where Sustainability-linked Loans shine, as they offer a far more comprehensive approach that is unburdened by predetermined allocations.

Read Press Release on how ESGpedia empowered OCBC to extend a S$16 million Sustainability Linked Loan (SLL) to global textile and apparel manufacturer, Ghim Li Group , through a fully digitalised and streamlined process on the platform.

Rise of Sustainability-Linked Loans: The Market Disruptor

The rise of sustainability-linked loans as a market disruptor gained momentum when industry bodies across Europe, Asia Pacific, and the US jointly published the SLLPs in 2019. ). Originating in the agricultural sector in 2014, these loans found early success with commercial banks partnering with major corporations like Olam and ING-Wilmar.

These early ventures into sustainability-linked lending laid the groundwork for SMEs to embrace these “covenant-lite” loans. It offers incentives for sustainability improvements without necessitating an external regulatory framework, allowing SMEs the opportunity to merge sustainability goals with profitability.

SMEs are Key Drivers in Achieving Net Zero

Individually, the impact of each SME might seem small, yet collectively, SMEs comprise a significant 95-98 percent of all enterprises in Southeast Asia, yielding a substantial aggregated influence; these SMEs account for at least 50% of GHG emissions within the business sector, and 30-60% of its energy consumption.

Recognition is growing among SMEs that aligning with ESG considerations is no longer optional, but rather an essential strategy to retain their position within larger business supply chains. With recent news of the EU supply chain law, whereby companies must disclose and manage their social and environmental impacts throughout their supply chain, it has become apparent that SMEs have a compelling imperative to integrate ESG into their operations.

Yet, the barrier of entry for SMEs into the sustainable finance landscape is tough, with the market typically reserved for entities with investment-grade ESG ratings. But with internal ESG metrics today surpassing such ratings in popularity as sustainability indicators, the doors are wide open for SMEs. Through concessional terms, both private and commercial banks, alongside institutional investors, are now incentivizing SMEs to embrace greening initiatives, marking a significant shift in approach.

This “bottom-up” strategy, despite potential administrative challenges and narrower profit margins, is steering the sustainability agenda in a promising direction.

Sustainability-Linked Loans in Asia

The Monetary Authority of Singapore (MAS) unveiled the Green and Sustainability-Linked Loan Grant Scheme (GSLS) on January 1, 2021. This landmark scheme extends its benefits not just to large corporations but also to SMEs, underscoring its commitment to sustainability. The GSLS has played a crucial role in fostering the development of frameworks tailored specifically for SMEs, recognizing their distinct challenges and opportunities in embracing sustainability.

Among the initiatives propelled by the GSLS is the OCBC SME Sustainable Finance Framework, introduced in November 2020. This framework leverages the impetus of the GSLS to streamline the process and reduce barriers for SMEs to embark on sustainability ventures.

Dyna-Mac Holdings, a local player in the oil and gas engineering sector, became the first SME to secure a sustainability-linked loan from OCBC in 2022. Armed with data from the Global Compact Network Singapore’s emissions recording tool, Dyna-Mac Holdings is poised to achieve an ambitious 25% reduction in carbon emissions within the next five years. This move sets a precedent for SMEs, demonstrating the practicality and impact of sustainability-linked loans in driving tangible change.

Sustainability-linked loans’ immense potential is catching on across Asia-Pacific, with many SMEs joining in on the action. For one, AU Optronics (AUO), a display manufacturer renowned for its advancements in computer screen technology, entered a noteworthy sustainability-linked loan agreement with DBS Taiwan. This strategic partnership sets a blueprint for emerging IT enterprises across the region, illustrating how sustainable finance can reshape industries from the ground up.

It’s all about the KPIs

At the heart of sustainability-linked loans lies a profound emphasis on Key Performance Indicators (KPIs). Issuers of sustainability-linked loans shoulder the responsibility of achieving their sustainability targets, elevating the significance of well-chosen KPIs. The updated SLLPs also add a crucial layer of accountability, mandating an independent external reviewer to assess the borrower’s performance against each KPI and Sustainability Performance Target (SPT). Due to this, the selection of appropriate KPIs takes centre stage, influencing the effectiveness of the entire sustainability-linked mechanism.

Credibility stands as a linchpin, resonating from both the borrower’s and lender’s perspectives. Failing to uphold the credibility of chosen KPIs can have consequences, tarnishing reputations and giving rise to greenwashing concerns – a phenomenon where sustainability claims are inflated or misleading. The oilfield services company Schlumberger signed an sustainability-linked loan in 2021 without disclosing its underlying KPIs, setting an unwelcoming precedent.

What are common KPIs to be included in Sustainability-Linked Loans?

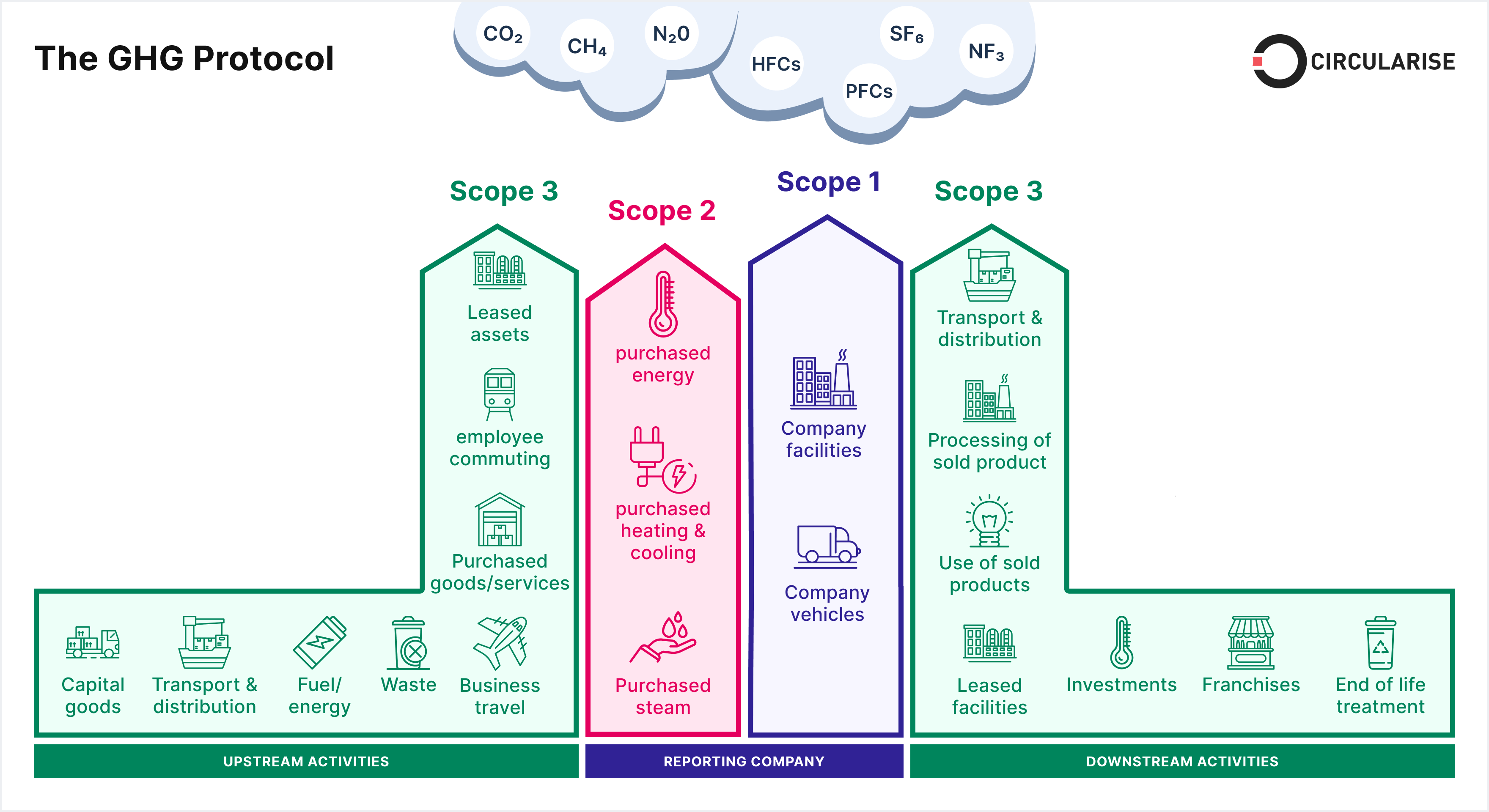

According to a recent report published by Environmental Finance, carbon emission reduction KPIs account for about 75% of KPIs used in sustainability-linked bonds and loans. When integrating a carbon emissions KPI, the focus lies on the company’s greenhouse gas (GHG) inventory. This comprehensive assessment encompasses three distinct scopes: Scope 1, which relates to direct emissions from a business’s operations; Scope 2, which involves indirect emissions from electricity and energy purchased; and Scope 3, encapsulating upstream and downstream emissions within the entire value chain.

While carbon emissions KPIs are commonly utilized, their application varies across industries. It’s imperative for each business to formulate KPIs that holistically encompass tailored economic, strategic, and sustainability consideration. According to SLLP, it’s prudent for businesses to adopt a best practice approach by conducting a materiality assessment, a process that aids in pinpointing the vital ESG considerations within their industry.

The measurement of carbon emissions KPIs presents two primary options: absolute emissions and intensity emissions. However, the selection of the appropriate metric is contingent upon the nuances of the industry and can’t be uniformly applied. For instance, the construction sector would typically opt for intensity emissions, evaluating their carbon footprint in relation to economic or production output. This industry-specific approach ensures a more accurate representation of environmental impact and allows for effective cross-sector comparisons.

How can SMEs set KPIs? It isn’t as Complex as it seems

Alas, a challenging paradox persists – while SMEs play a pivotal role in driving net-zero goals, they often struggle to secure the financing required for meaningful decarbonization efforts. Obstacles remain, ranging from stringent lending policies that demand high collateral security and incur transaction costs to the challenge of small project ticket sizes, making sustainability for businesses a challenging endeavour.

In the EU, resource limitations and skills gaps pose challenges for SMEs, with 27% citing financial constraints and 15% expressing concerns about skills scarcity. “The biggest problem, however, is collection of data itself,” notes Kimberly Lee, Senior Strategy & Business Development Manager, Carbon Solutions Lead at STACS. What is the fuel consumption of your company? How does this convert into emissions? Data acquisition remains a key challenge; without cognizance of their carbon footprint and sustainability profiles, SMEs are inherently obstructing the establishment of effective KPIs.

Fortunately, given the array of dedicated green initiatives and technology solutions rolled out by both public and private sectors to foster net-zero ambitions, it isn’t as complex as it seems.

Low Carbon SG – Carbon Emissions Reduction Programme

LowCarbonSG, spearheaded by the Carbon Pricing Leadership Coalition (CPLC) Singapore, offers SMEs a capability-building program. This initiative equips SMEs with a Carbon and Emissions Recording Tool (CERT), enabling them to accurately measure, monitor, and curtail their carbon emissions. This tool is designed to facilitate the emission calculation process through inbuilt formulas, catering to diverse data sources including energy consumption, waste, and transportation data. The program’s alignment with international standards like the Greenhouse Gas Protocol bolsters its credibility, offering a tangible pathway for SMEs new to the decarbonization journey.

Participation in this program potentially opens doors for green certifications, although such certifications may not be obligatory anymore. In the past two years, OCBC extended green loans to over 500 SMEs, with only one in three needing to validate the green criteria with a green certificate. OCBC’s approach emphasizes that SMEs need not navigate complex certification processes to avail themselves of green financing options.

ESGpedia’s ESBN Asia-Pacific Green Deal Program – Streamlining emissions data collection and verification process for banks to extend SLLs to SMEs

The ESBN Asia-Pacific Green Deal for Businesses, accessible for free through ESGpedia, is a user-friendly digital self-assessment that empowers corporates and SMEs to initiate their sustainability journey seamlessly. The tool digitalises and simplifies ESG metrics, and features an in-built carbon calculator with localized emission conversion factors for different countries in the region that automatically converts operational data like electricity and water bill into carbon footprint of the company. Moreover, it categorizes sustainability into five distinct pillars, streamlining the path for SMEs to enhance their ESG profile.

The free ESBN self-assessment tool on ESGpedia empower SMEs to leverage digitalisation to get started on their ESG reporting journey . Businesses are also awarded with the ESBN Green Deal badge upon successful completion of the self-assessment.

View the first batch of ESBN Green Deal Badge Achievers here.

The tool on ESGpedia has enabled banks to streamline the process of emissions data collection and extending of sustainability-linked loans to SMEs. Read our Press Release with OCBC and Ghim Li here, on how the entire process of extending a S$16 million Sustainability Linked Loan (SLL) was digitalised and streamlined on ESGpedia.

Collaboration with third-party verification bodies such as Bureau Veritas (through ESGpedia’s Marketplace) also helps ensure that the data disclosed by businesses through the assessmentis accurate, quelling fears of greenwashing and allowing Financial Institutions access to credible data for sustainability-linked financing.

Lowering the barriers of entry to sustainability with Tech

Within the evolving business landscape, the democratization of sustainability-linked loans reflects a practical departure from their historical association solely with large corporations. This shift underscores a collective commitment to sustainability, involving stakeholders at every stage of the value chain – SMEs to industry giants and the financial institutions that underpin their endeavours.

Enabled by technological advancements, SMEs now find themselves better equipped to navigate the challenges that have historically hindered their sustainability efforts, especially when concerning data availability.

By capitalizing on the potential of sustainability-linked loans, SMEs now hold the reins to steer their businesses towards environmentally conscious practices, driving not only their own growth but also propelling the collective journey towards a greener tomorrow. The road to sustainability may seem arduous and complex for SMEs with lower capacity and resources. But this is slowly changing through Sustainability-Linked loans, and the emergence of digital tools such as LowCarbonSG and the ESBN Green Deal digital assessment on ESGpedia.