The Future of Real Estate: How Sustainable Green Building Is Changing The Industry

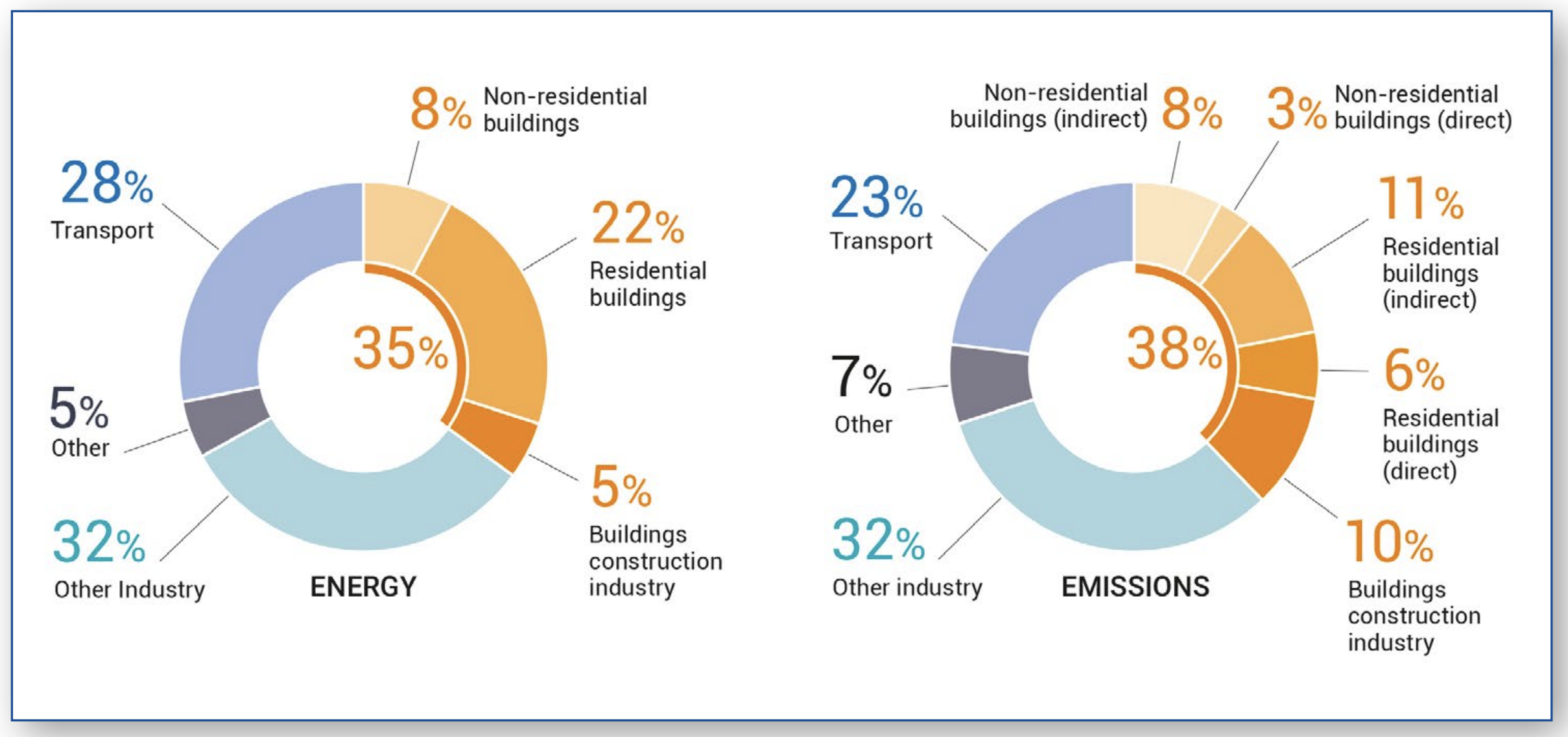

Singapore is on track to become the greenest city by 2030, with the BCA targeting to achieve 80% green buildings by 2030. Real estate is a key global contributor of carbon emissions, accounting for 40% per cent of total emissions, of which around 70% are created by general building operations while the rest are produced by the initial construction process itself. The Bank of England’s research revealed that real estate with high carbon emissions saw a decrease in value following the introduction of environmental regulations.

Investors from major firms to individual homeowners are demonstrating a preference for eco-friendly properties, highlighting the worries of carbon-intensive real estate leading to heightened expenses and decreased appeal. McKinsey research estimates approximately $9.2 trillion in annual investment will be required globally to support the net-zero transition.

To illustrate the scale of the challenge, the Urban Green Council found in 2019 that retrofitting all 50,000 buildings in New York alone would cost up to $24.3 billion through 2030. We can expect similar costs in similarly sized cities globally, including in Asian metropolises like Singapore, Hong Kong, Beijing, Kuala Lumpur, Bangkok, Manila, and Jakarta.

According to a report by the World Economic Forum, in the next 40 years, the equivalent of a city with the magnitude of Paris is projected to be developed every week. Since the production of concrete contributes to 8% of global emissions, the way we construct and design new constructions must be changed drastically to meet our climate ambitions. Enhancements in design to use less material, advanced materials, fresh building methods, and augmented use of technology are all supporting to diminish the whole-life carbon impact of upcoming projects.

Challenges in sustainable real estate

While real estate companies are making efforts to reduce their emissions and carbon footprint, challenges remain. Singapore local bank OCBC recently issued a sector report warning real estate companies reliant on funding that they could be compelled to comply with sustainability practices or face reduced funding opportunities. Green capital is currently not mobilised as efficiently as it could be, with banks facing a lack of sustainability data as well as very manual and time consuming review processes before being able to offer green financing (more on that later).

Green Building Certifications

Image: GreenA Consultants

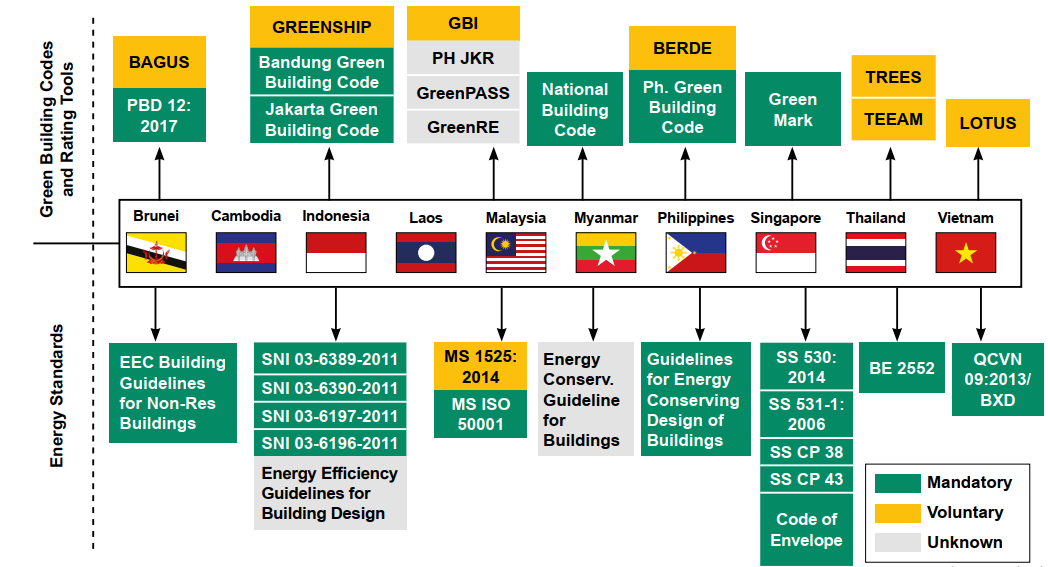

Given the various sustainability building certifications and standards/ratings systems available – from the Singapore Green Building Product (SGBP) scheme by Singapore Green Building Council (SGBC) to Singapore’s national green building rating tool administered by the Building and Construction Authority (BCA) Green Mark, as well as global standards such as LEED – it is understandable that some companies in the real estate sector may not be sure where to start.

Different levels of SGBC-certified sustainable building materials, such as concrete and steel with lower carbon footprints as well as conservation and resource recovery efforts during demolition phases, award different points under the Green Mark scheme. This ultimately gives developers an end score for the overall project resulting in Green Mark Platinum (70 and above), Gold Plus (60-70), or Gold (50-60), and so on.

“Sustainability building certifications are important because they help the financial institutions (FIs), investment managers, and REIT developers have common criteria to screen their portfolio companies. Increasingly, FIs are looking towards certificates to inform their criteria for benchmarking.”

Under the global LEED scheme by the U.S. Green Building Council (USGBC), projects are awarded points that correspond to a level of LEED certification including Certified (40-49 points), Silver (50-59), Gold (60-79), and Platinum (80+). Asides from those already mentioned, it’s worth citing the World Green Building Council (WGBC), a global network of national Green Building Councils with member councils in over 70 countries representing more than 49,000 members. Countries may also have their own local certification bodies, each with their own localised certifications. For instance, the Green Building Council of Australia (GBCA) has their own Green Star certification, and Hong Kong Green Building Council (HKGBC) has their own BEAM Plus certification.

Confusion in Regulations

Beyond certifications, another area of confusion for some businesses in the real estate sector is regulations, which are constantly evolving and vary by jurisdiction.

In Singapore, for example, to support the real estate sector in becoming more green, the government has made available grants to property developers to reduce emissions through retrofitting. It has also introduced sustainability targets for the sector in its Singapore Green Building Masterplan as part of Singapore Green Plan 2030, and plans to issue S$35 billion in green bonds by 2030 to be used in eight project categories with green buildings among them.

As things stand, most ESG disclosures by real estate developers are optional rather than mandated by law, with regulators and financial institutions encouraging participation through financial incentives such as low-interest sustainability-linked loans (SLLs) and reputational benefits enjoyed by putting in the effort of complying with the highest sustainability standards.

Lee mentioned, “Clients of the real estate companies can influence developers to become more sustainable, as they [the clients] may already be subject to ESG regulations in the USA or Europe and expect similar procurement standards across their Asia operations.”

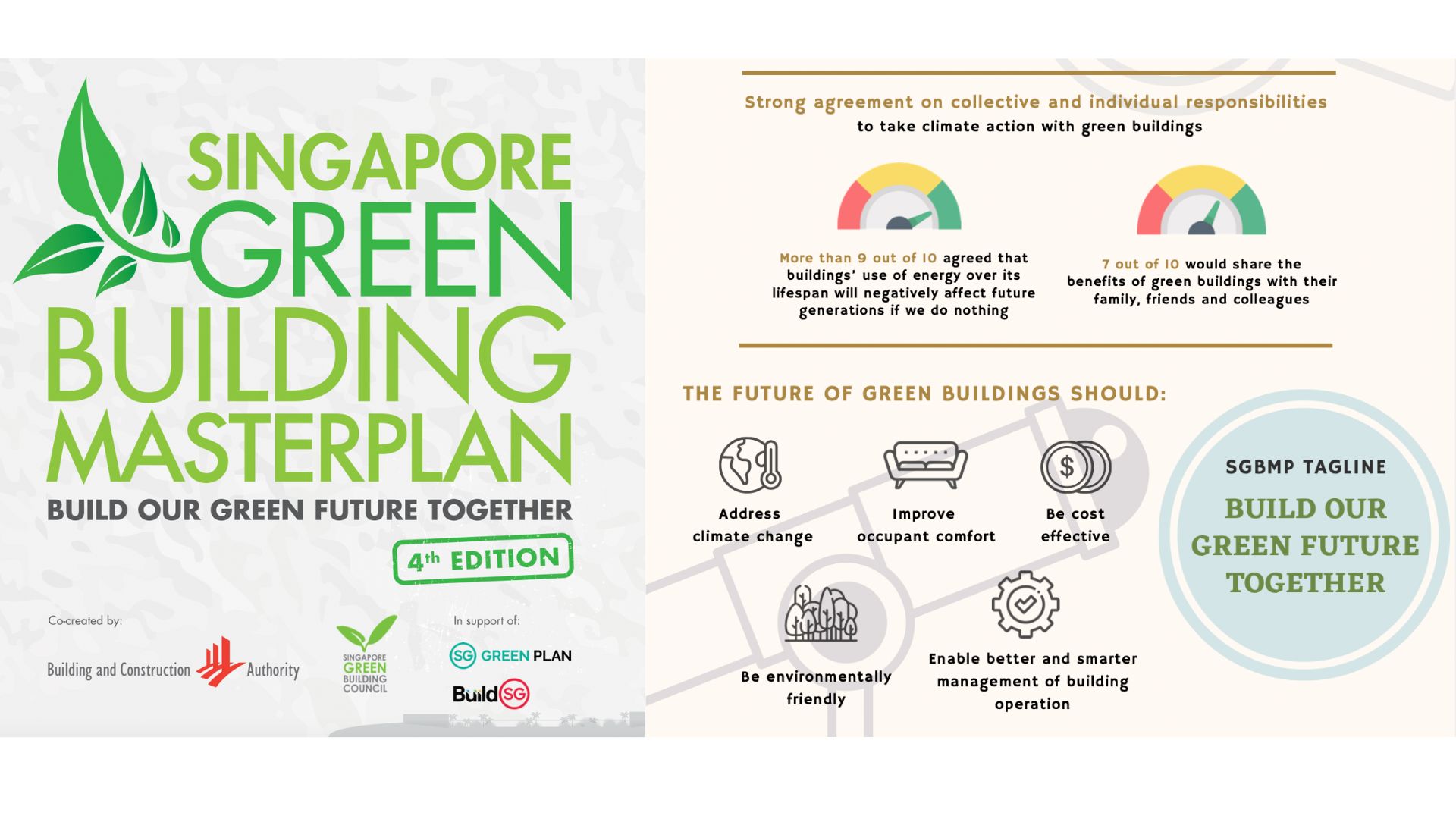

Building for Tomorrow: Singapore’s Green Building Master Plan 2030 (SGBMP)

The myriad of benefits that sustainable real estate offers, far supersedes the efforts to implement. In addition to cost savings and increased property value, the long term prospects attract more attention and interest due to purported health and well being benefits that come from improved air quality, non-toxic materials that are greener and healthier.

Owners of commercial buildings are now incentivised to raise energy performance with benefits such as lowered upfront capital cost, with effect from Q2 2022 with the Green Mark Incentive Scheme for Existing Buildings 2.0 (GMIS-EB 2.0). Aligned with the Singapore Green Plan 2030, BCA and Singapore Green Building Council have worked together to conduct surveys in determining what the public want to see in the SGBMP.

Ms Yvonne Soh, Executive Director, Singapore Green Building Council, said: “It’s not just investors and financiers that have recognised the regulatory and climate transition risks that real estate will be subject to. Market preferences are also changing, with more consumers choosing to live more sustainably as the effects of climate change have become more real and tangible. With the majority of our time spent within buildings, whether for work, recreation or in our homes, consumers want their living environment to be one that saves on energy and water bills, conserves resources and enhances their wellbeing. And that’s what Green Buildings are all about.”

Key outlines in the Green Building Master Plan 2021 include:

- Target to green 80% of buildings by 2030

- Turn 80% of new developments by Gross Floor Area to be Super Low Energy (SLE) buildings by 2030

- Achieve 80% improvement of energy efficiency for best-in-class green buildings by 2030

Read the full Green Building Masterplan and view the infographics here.

Providing a common Digital Registry for the Real Estate sector across Asia

“[Our partnership with STACS ESGpedia and Evercomm] ensure transparency, accountability and compliance of international standards in their sustainability reporting and carbon-related projects. Such credibility provides a win-win benefit during trade investments.”

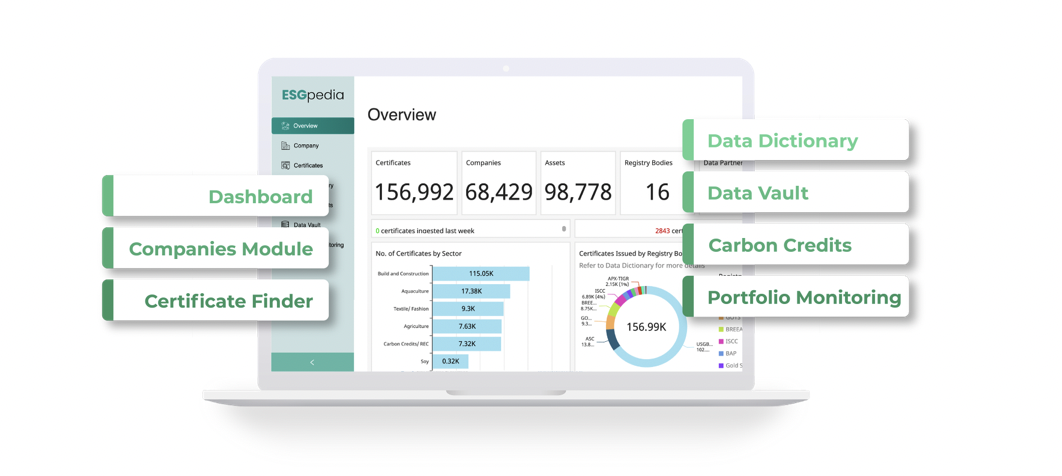

ESGpedia by STACS is a one-stop platform that pulls together all the various certifications from local and global industry-recognised bodies, as well as other types of ESG data disclosures from real-time technologies like IoT and drones. This common digital registry is available today, helping to address many of the real estate industry’s challenges when it comes to becoming more sustainable.

While data aggregation and transparency is a key objective, Tan highlighted the importance of respecting data privacy: “We understand that some real estate companies may be hesitant to share their buildings’ ESG data on a public registry. To solve this issue, ESGpedia has a data consent mechanism whereby the company has to grant permission before users can get access to the data. Our goal with this approach is to increase transparency, but do so in a controlled manner. Ultimately we leave it up to each company to decide what and how much they want to disclose.”

How ESGpedia empowers Different Personas in their Journey toward Sustainable Real Estate and Net Zero

Benefits for Corporates:

Many of the largest corporates in the world have made commitments to greening their operations. Real estate companies face increasing pressure to track and evidence their sustainability and decarbonisation efforts if they wish to remain competitive, meet stakeholders’ expectations, and attain the required sustainable financing. This is something ESGpedia is well positioned to help corporates do, through the creation of a company ESG profile, which includes key ESG metrics that will be globally accessible to users.

Benefits for SMEs:

Real estate SMEs need help educating themselves and understanding how to quantify their building emissions, as well as the initial steps they should take to begin their sustainability journeys. At STACS, we are co-hosting workshops with various trade associations in each industry, bringing in our partners from various personas, such as certification bodies, banks, and more, to share how companies can leverage on existing technology solutions, programs, and green financing, to embark on their sustainability journey. By attending these workshops and being exposed to a digital data platform like ESGpedia, real estate SMEs will be better positioned to take advantage of ESG certificates and make relevant data disclosures to attract clients and financing.

Sign up now to get a free trial of how you can start your net zero journey.

Benefits for Financial Institutions:

Lee mentioned, “Banks have a mandate to decarbonise their portfolios and scale green financing. They start by looking at existing clients in a particular sector, like real estate for instance, and speaking to them individually to get a better understanding of where they are on their sustainability journeys. This process is quite manual and time consuming. Data exchanges on sustainability credentials are often faciliated through back and forth emails.

With ESGpedia, banks can have a good understanding and snapshot of their clients’ ESG commitments – whether they have obtained a certification, what kind of certificates they have, and what certification level did they achieve. This helps to facilitate a more targeted engagement process to incentivise their clients’ sustainability efforts, accelerating the transition to net zero both for banks and their clients.”

Enabling Sustainable Real Estate via ESGpedia

“As of March 2023, ESGpedia hosts over 219,323 certificates from the real estate sector, ingested from global verified sources.”

ESGpedia empowers the various real estate sector stakeholders – be it the larger corporates, SMEs, insurers, or financiers – to embark on their sustainability journey with confidence by gaining a deeper understanding of their current ESG position today. Our platform supports stakeholders in assessing the appropriate next-steps to advance their sustainability objectives. This may include ESG financing for green solutions, green credentials for supply chain tracking and monitoring, or carbon offsetting for residual emissions to attain net zero.

Connect with us to learn how we enable real estate businesses to calculate their carbon footprint via our ESGpedia solution.

What Does ‘Good’ Look Like for the Real Estate Sector?

When asked what ‘good’ will look like for ESG in tomorrow’s real estate sector, Tan laid out a vision where every building has already attained a sustainability certification. At that stage, the conversation is less about who has and doesn’t have a green certification, and more about the level of certification secured.

Tan concluded, “Ultimately, everyone will be pushing and motivating one another towards obtaining a higher standard of green certification, collectively contributing towards a greener tomorrow.”

Sustainable Real Estate is not going away

While trends change each year, we believe ESG real estate is one that’s here to stay. Supported by governments and with growing incentives from financial institutions through efforts to scale sustainable financing, as well as the changing demands of property tenants/clients, achieving green real estate is a key piece in the puzzle of a greener tomorrow.

Asia may have its own building certifications, regulations, and local banks financing the real estate sector, but the region is not isolated from the rest of the world. Europe and the USA also indirectly influence Asia’s real estate market, with their companies and investors coming here to operate their businesses – importing not just their products and services but also expectations when it comes to ESG standards.

Sign up for a free trial today, to get started on your sustainability journey and gain access to holistic ESG data and digital tools.